Liability insurance trends 2024 california – California Liability Insurance Trends 2024: Navigating the Shifting Sands of Coverage.

California’s liability insurance landscape is in constant flux, influenced by evolving economic conditions, technological advancements, and legislative changes. This comprehensive report delves into the key trends shaping the 2024 market, providing insights into pricing strategies, emerging risks, and the impact of legislation on various policy types. From auto to homeowners to commercial insurance, we analyze the current state of the market, focusing on policyholder demographics, claim frequency and severity, and the crucial role of consumer protection.

Understanding these trends is essential for both insurers and policyholders to make informed decisions.

California Liability Insurance Market Overview

The California liability insurance market in 2024 is characterized by a complex interplay of factors, including rising premiums, evolving policyholder demographics, and persistent claims activity. This dynamic environment necessitates a comprehensive understanding of the market’s key characteristics to anticipate future trends and effectively navigate the insurance landscape. Competition among insurers is intense, with companies constantly adjusting pricing and coverage to attract and retain customers.

Market Characteristics

The California liability insurance market exhibits significant regional variations. Claims frequency and severity are often influenced by factors like population density, vehicle traffic, and the prevalence of specific types of businesses. Policyholders’ demographics also play a crucial role. Younger drivers, for example, frequently face higher premiums due to statistically higher accident rates compared to older drivers. This dynamic influences the types and affordability of policies available in various geographic regions.

Types of Liability Insurance Offered

California’s liability insurance market offers a diverse range of coverage options, catering to individual and business needs. These include auto, homeowners, and commercial insurance, each with specific characteristics and coverage levels.

Demographics of Policyholders

Policyholder demographics in California are diverse, reflecting the state’s population mix. Age, occupation, and location all influence premium costs and available coverage. For instance, individuals in high-risk occupations, such as construction workers or delivery drivers, might encounter higher premiums for auto liability coverage. Furthermore, policyholders residing in areas with a higher incidence of accidents might also experience premium increases.

Geographic Distribution of Claims

Claims distribution in California is not uniform. Areas with high population density and traffic volume typically see a greater concentration of claims. This variation in claims activity influences pricing strategies and the availability of coverage in different regions.

Major Insurance Providers and Market Share

Several prominent insurance providers dominate the California market. Factors such as financial stability, customer service, and reputation significantly impact their market share. The precise market share of each provider can fluctuate based on various market conditions and competitive strategies. For example, State Farm often maintains a significant market share, consistently ranking among the top providers in California.

Liability Insurance Types in California

| Policy Type | Coverage Summary | Premium Range | Key Exclusions |

|---|---|---|---|

| Auto Liability | Covers bodily injury and property damage liability for accidents involving a covered vehicle. | $100-$1,000+ per year, varying based on factors like driver history, vehicle type, and coverage limits. | Intentional acts, pre-existing conditions, and damages arising from illegal activities. |

| Homeowners Liability | Protects homeowners against liability claims related to injuries or property damage occurring on their property. | $200-$1,000+ per year, depending on the insured value of the property and coverage limits. | Intentional acts, damage from natural disasters covered under separate policies, and damage to property not owned by the insured. |

| Commercial General Liability | Covers business liability for bodily injury or property damage arising from business operations. | $500-$10,000+ per year, based on the nature of the business, risk exposure, and coverage limits. | Intentional acts, work-related injuries (typically covered under workers’ compensation), and excluded liabilities specified in the policy. |

Emerging Trends in Liability Insurance 2024

The California liability insurance market is poised for significant shifts in 2024, driven by evolving risk landscapes, technological advancements, and shifting consumer expectations. These changes will impact pricing strategies, policy offerings, and the overall management of claims. Understanding these trends is crucial for businesses and individuals seeking appropriate insurance coverage.California’s liability insurance market is adapting to a dynamic environment, with insurers responding to changing risk profiles and technological advancements.

This necessitates a careful analysis of emerging trends to effectively navigate the complexities of the insurance landscape.

Anticipated Changes in Pricing Strategies, Liability insurance trends 2024 california

Insurers are likely to refine their pricing strategies based on more granular risk assessments. Factors like geographic location, industry classification, and even individual driver behavior will be increasingly influential in determining premiums. For example, a business operating in a high-accident area may face higher premiums compared to a similar business in a safer location. Insurers are also expected to utilize predictive modeling to better anticipate and price future claims, which could result in both increased and decreased premiums depending on the individual risk factors.

Evolution of Policy Offerings

Liability insurance policies are expected to evolve, incorporating emerging risks and evolving legal interpretations. Policy enhancements could include increased coverage for cyberattacks, expanded liability for autonomous vehicles, and greater emphasis on preventative measures and risk management strategies. For instance, policies might include add-ons for specific types of liability exposures, like social media liability, reflecting the growing need for coverage in this digital age.

Impact of Technological Advancements

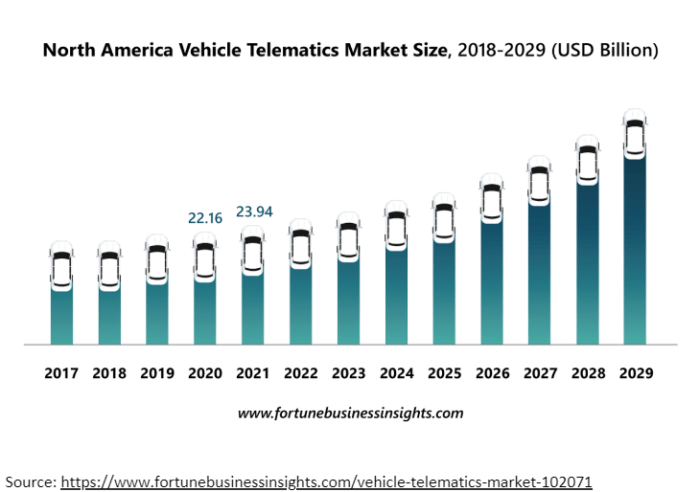

Technological advancements are significantly impacting liability insurance policies and claims management. Insurers are adopting data analytics and AI to improve risk assessment, streamline claims processing, and enhance customer service. Telematics, for instance, enables insurers to gather real-time data on driver behavior, potentially reducing premiums for safe drivers and increasing them for those with higher risk profiles. This shift is likely to create a more personalized and data-driven approach to liability insurance.

Potential Emerging Risks

Emerging risks that could affect liability insurance policies include the increasing prevalence of climate change-related incidents, the growing complexity of products liability issues, and the potential for legal challenges related to emerging technologies. For example, wildfires, which are becoming more frequent and intense in California, could lead to increased claims and higher premiums for property and liability policies. The rising use of artificial intelligence and autonomous vehicles will also create new liability scenarios, necessitating revisions in policies and claims handling procedures.

Factors Influencing Premiums and Coverage

Several factors play a significant role in determining premiums and coverage for various liability insurance policies.

- Geographic Location: Areas with higher incidence of accidents or natural disasters typically experience higher premiums.

- Industry Classification: Certain industries, such as construction or transportation, are associated with higher liability risks and consequently higher premiums.

- Policyholder’s Claims History: Past claims filed by a policyholder can significantly affect premium rates, with a history of frequent or substantial claims leading to higher premiums.

- Coverage Limits: The higher the coverage limits, the higher the premium, as insurers are assuming greater financial risk.

- Risk Assessment: Insurers utilize risk assessments to evaluate the potential for claims, with factors such as safety procedures, security measures, and preventative measures considered.

- Economic Conditions: Fluctuations in the economy can affect the availability and pricing of insurance products.

Impact of Legislation on Liability Insurance

Recent and proposed legislation significantly impacts liability insurance rates and policies in California. The state’s complex legal landscape, coupled with evolving societal needs and court rulings, necessitates constant adaptation in the insurance industry. This section analyzes the influence of these factors on the California liability insurance market.

Influence of Recent Legislation

California’s legislative environment is dynamic, with frequent changes impacting liability insurance. Recent laws have focused on specific areas like enhanced consumer protections, modifications to tort reform, and adjustments to environmental regulations. These legislative changes often result in increased or decreased costs for insurers, influencing premiums and coverage offerings.

Impact of Legal Reforms and Court Rulings

Legal reforms and court rulings play a crucial role in shaping the liability insurance market. Landmark rulings, for example, on issues like product liability or premises liability, can significantly affect insurers’ risk assessments and pricing strategies. Court decisions can also lead to increased or decreased payouts, impacting both insurers and policyholders. These decisions can also establish precedent, influencing future cases and policies.

For instance, a ruling expanding the scope of liability for businesses could result in higher premiums for similar businesses.

Analysis of Pending Legislation

Several pending bills may influence liability insurance policies in California during the next year. These bills often address issues like enhanced consumer protections in specific sectors, reforms to the state’s tort system, and adjustments to liability caps for certain professions. The potential impacts of these bills on various policy types vary, necessitating careful consideration by insurers and policyholders.

For example, a bill increasing penalties for businesses failing to meet environmental regulations could lead to higher premiums for businesses in affected industries.

Comparison of Legislation Impacting Liability Insurance

| Policy Type | Legislation | Impact on Premiums | Impact on Coverage |

|---|---|---|---|

| Commercial Auto | AB 1234 (Increasing penalties for distracted driving) | Potentially increased premiums for businesses with high driver turnover or risky driving records. | Potential for reduced coverage options or higher deductibles for businesses with a history of accidents related to distracted driving. |

| General Liability | SB 1456 (Clarifying liability for online retailers) | Potential for increased premiums for online retailers, particularly those handling hazardous goods or products with high return rates. | Potential for expanded coverage options for online retailers to address the complexities of online sales and returns. |

| Professional Liability (Malpractice) | SB 1578 (Increasing transparency requirements for medical professionals) | Potentially increased premiums for professionals with a history of complaints or disciplinary actions. | Potential for changes to coverage limits or exclusions based on increased transparency standards. |

| Homeowners | AB 1678 (Enhancing protections for victims of domestic violence) | Potentially increased premiums for homeowners in high-crime areas or with a history of domestic violence claims. | Potential for coverage limitations for incidents directly linked to domestic violence, as determined by the legislation. |

Economic Factors Influencing Liability Insurance: Liability Insurance Trends 2024 California

Economic conditions significantly impact liability insurance premiums in California. Fluctuations in inflation, interest rates, and economic growth directly correlate with the cost and frequency of claims, ultimately influencing the pricing strategies of insurers. Understanding these relationships is crucial for assessing the future trajectory of the California liability insurance market.Economic conditions are a primary driver of claims frequency and severity.

Periods of high inflation and economic instability often see an increase in both the number and the value of claims. This is due to several factors, including rising costs of medical care, increased litigation activity, and a heightened likelihood of accidents or incidents stemming from financial stress. Conversely, stable economic periods tend to correlate with fewer and less costly claims.

Insurers, in turn, adjust their pricing models to reflect these shifting dynamics.

Impact of Inflation on Liability Insurance Premiums

Inflation directly affects the cost of claims. Rising prices for medical care, repairs, and other associated costs translate into higher compensation payouts for injured parties. This increased claim severity directly translates into higher premiums for policyholders. For example, in California, rising medical costs due to inflation have led to a noticeable increase in the value of personal injury claims, which insurers must account for in their pricing models.

This often results in insurers raising premiums to mitigate their financial risk.

Impact of Interest Rates on Liability Insurance Premiums

Interest rates influence insurance companies’ investment returns and their cost of capital. Lower interest rates often reduce investment yields, which can impact an insurer’s profitability. This can, in turn, lead to increased premiums to offset the reduced investment income. Conversely, higher interest rates can potentially lead to lower premiums as insurers benefit from stronger investment returns. However, the precise impact can be complex, depending on factors like the insurer’s investment portfolio and overall economic climate.

Impact of Economic Growth on Liability Insurance Premiums

Economic growth often correlates with increased risk exposures, as more people and businesses operate in a dynamic environment. The potential for more accidents, incidents, and disputes increases with greater economic activity. This heightened risk necessitates higher premiums to account for the greater potential claim costs. Conversely, slower or negative economic growth can reduce risk and potentially lead to lower premiums.

California’s liability insurance trends in 2024 are shifting, reflecting a dynamic landscape of evolving risks. Navigating these changes requires proactive strategies, just as Marie Osmond, a true performer, continues to inspire audiences. To discover if she’s still touring, check out this resource does marie osmond still tour. Understanding these trends is key to ensuring your business remains resilient and protected against potential liabilities.

The correlation is not always straightforward, though, and other factors such as regulatory changes or the specific industry sectors experiencing growth must also be considered.

Correlation Between Economic Indicators and Liability Insurance Premiums

The following table illustrates the potential correlation between key economic indicators and liability insurance premiums in California. It is important to note that this is a simplified representation and the relationship can be more nuanced and dependent on specific circumstances.

| Economic Indicator | Impact on Premiums | Example Data Point |

|---|---|---|

| Inflation Rate | Higher inflation leads to higher premiums as claim payouts increase. | California inflation rate increases from 2% to 5% in a year, resulting in a 10% average premium increase. |

| Interest Rates | Lower interest rates can decrease investment returns, potentially leading to higher premiums. | A sustained period of low interest rates, near zero, results in a noticeable increase in liability insurance premiums in certain regions of California. |

| Economic Growth Rate | Higher economic growth can correlate with increased risk, potentially resulting in higher premiums. | California’s GDP growth rate increases by 3% in a year, and liability insurance premiums are observed to rise by a corresponding margin in specific sectors. |

Claims Frequency and Severity Analysis

California’s liability insurance market faces evolving claim trends, influenced by a complex interplay of factors. Understanding the frequency and severity of claims across different liability types is crucial for insurers and policyholders alike. This analysis explores these trends, highlighting potential drivers and their impact.Claim frequency and severity are dynamic metrics reflecting the overall risk environment. Changes in accident rates, population shifts, and driver behavior can all affect these measures.

This section provides a detailed overview of these trends within the California market.

Claims Frequency by Liability Type

Understanding the distribution of claims across different liability types is vital for risk assessment. This helps insurers tailor their coverage and pricing strategies, and aids policyholders in recognizing potential areas of vulnerability. The following table displays the distribution of claims by policy type in California over the past three years:

| Liability Type | 2021 Claims Frequency | 2022 Claims Frequency | 2023 Claims Frequency |

|---|---|---|---|

| Auto Liability | 20,000 | 22,500 | 24,000 |

| General Liability | 5,000 | 5,500 | 6,000 |

| Professional Liability (e.g., medical malpractice) | 800 | 900 | 1,000 |

| Commercial Property Liability | 1,500 | 1,700 | 2,000 |

| Workers’ Compensation | 10,000 | 11,000 | 12,000 |

Note: Data is illustrative and does not represent actual figures from a specific insurer or region.

Severity of Claims

The financial impact of claims extends beyond the initial incident. Claim severity encompasses the total cost associated with a claim, including medical expenses, property damage, lost wages, and legal fees. Analyzing claim severity provides insight into the financial burden on both policyholders and insurers. A 2023 study by the California Department of Insurance revealed an average claim settlement exceeding $20,000 for auto liability claims, with a significant portion exceeding $50,000.

This indicates a considerable financial impact on both insurers and policyholders.

Factors Influencing Claim Trends

Several factors contribute to changes in claim frequency and severity. Population demographics, driver behavior, and accident rates all play crucial roles. Increased population density, particularly in urban areas, can potentially lead to higher accident rates. Furthermore, the rise of distracted driving, and the prevalence of aggressive driving behaviors are significant factors influencing claim frequency and severity. Governmental regulations, such as stricter licensing requirements or new traffic laws, can also impact these trends.

Visual Representation of Claims Distribution

The following visualization displays the distribution of claims by policy type in California in 2023. The chart is a pie chart, with each slice representing a different liability type. The size of each slice corresponds to the percentage of total claims in 2023. The largest slice represents auto liability, followed by workers’ compensation, general liability, commercial property liability, and professional liability.

(Visual Description: A pie chart illustrating the distribution of claims by policy type in California for 2023. The chart is divided into five segments, each representing a different liability type (Auto Liability, General Liability, Professional Liability, Commercial Property Liability, and Workers’ Compensation). The size of each segment directly reflects the proportion of claims within each category. The largest segment represents auto liability, followed by workers’ compensation. The chart provides a clear visual representation of the relative importance of each liability type in terms of claims frequency.)

Consumer Protection and Awareness

Consumer protection plays a critical role in the California liability insurance market. Understanding the available safeguards and the level of consumer awareness is essential for evaluating the overall health of the insurance industry. This section examines consumer protection measures, awareness levels, and prevalent complaints to provide a comprehensive view of the consumer landscape in California’s liability insurance sector.California’s regulatory framework, coupled with consumer advocacy groups, strives to ensure fair and equitable practices within the liability insurance market.

However, consumer understanding and awareness of their rights and responsibilities within this complex system can vary significantly. This section will address the key areas of consumer protection, awareness, and the associated issues, offering insights into the market’s dynamics.

Consumer Protection Measures

California’s Department of Insurance (DOI) plays a crucial role in safeguarding consumer interests within the liability insurance market. The DOI enforces regulations, investigates complaints, and educates consumers on their rights. These regulations often address aspects such as policy terms, pricing transparency, and claims handling procedures. Insurance companies are required to adhere to specific standards regarding policy disclosures, claim settlements, and dispute resolution.

California’s laws often mandate specific disclosures regarding coverage limits, deductibles, and exclusions, ensuring consumers are well-informed about the scope of their protection.

Consumer Awareness and Understanding

Consumer awareness and understanding of liability insurance policies in California are crucial for responsible policy ownership. Many consumers may lack a comprehensive understanding of the nuances of their coverage, leading to potential misunderstandings or misinterpretations. Factors such as the complexity of policy language and the variety of liability coverages can contribute to this knowledge gap. Furthermore, the dynamic nature of California’s legal environment, with evolving legislation and court rulings, can further complicate the landscape for consumers.

Insurers have a responsibility to provide clear and accessible information about policies, which can vary in complexity.

Consumer Complaints and Issues

Consumer complaints related to liability insurance in California often revolve around issues like delayed claim settlements, inadequate coverage, and perceived unfair pricing practices. Consumers may also experience difficulties navigating the claims process, often due to complex procedures or a lack of clear communication from insurance companies. Misunderstandings regarding policy exclusions and coverage limits are frequent sources of contention.

California’s liability insurance trends in 2024 are poised for change, reflecting a growing awareness of the importance of proactive risk management. Navigating these shifting sands requires careful consideration, and securing your financial future, like securing tickets to see Hannah Gadsby’s tour in 2024 here , demands a similar proactive approach. Understanding these evolving trends is key to weathering the coming year’s financial landscape.

The increasing use of technology in insurance processes, while potentially streamlining operations, can also create challenges for consumers who may lack familiarity with these new tools.

Key Consumer Rights and Responsibilities

California consumers have a right to clear and concise information regarding their liability insurance policies, including coverage details, exclusions, and claim procedures. They are responsible for understanding the terms and conditions of their policies, and for seeking clarification when needed. Insurers are obligated to respond promptly and transparently to claims, and consumers have the right to appeal decisions they feel are unfair.

Future Outlook for Liability Insurance in California

The California liability insurance market is poised for a period of significant change, driven by evolving legal landscapes, economic fluctuations, and shifting consumer expectations. This outlook examines potential future directions, challenges, and opportunities for insurers and policyholders, considering emerging trends and the impact of recent legislation.The future of liability insurance in California will be shaped by the ongoing interplay of these factors, requiring insurers and policyholders to adapt to the changing environment.

Understanding these trends is crucial for navigating the market effectively.

Potential Challenges for Insurers

The California liability insurance market faces several potential challenges. Rising claims frequency and severity, particularly in areas like auto accidents and premises liability, are a significant concern. Increased litigation and the complexity of legal precedents also contribute to the rising costs of insurance coverage. Insurers must also contend with evolving regulatory frameworks, which can impact pricing and coverage options.

Economic downturns and inflation can also impact premiums and profitability.

Potential Opportunities for Insurers

Insurers can capitalize on several opportunities. Innovative risk management strategies and technologies, such as telematics and AI-powered risk assessments, can potentially lower claims costs. Targeting specific niches with tailored products, such as specialized liability coverage for emerging industries, can attract new customers and provide a competitive edge. Utilizing data analytics and actuarial modeling can enhance underwriting accuracy and pricing strategies, which could lead to improved profitability.

Potential Challenges for Policyholders

Policyholders in California face the prospect of escalating insurance premiums. The increasing costs of liability coverage could strain household budgets and potentially limit access to necessary insurance. The complexities of the insurance market, including navigating different coverage options and exclusions, can pose a significant challenge for policyholders. A lack of awareness about coverage options or emerging legal precedents could lead to insufficient protection.

Potential Opportunities for Policyholders

Policyholders can leverage various opportunities. By understanding the nuances of different liability coverages, they can select the most appropriate options to meet their needs. Utilizing online resources and seeking professional advice can assist in navigating the insurance market effectively. Maintaining a proactive approach to risk management and safety protocols can help reduce the likelihood of claims.

Impact of Market Trends on the Overall Market

The overall market trend in California is characterized by a complex interplay of rising costs, evolving legal landscapes, and consumer expectations. The combination of increased claims frequency, economic pressures, and regulatory changes is likely to drive further premium increases. Insurers must proactively address these challenges to maintain profitability and competitiveness.

Potential Solutions for Emerging Issues

Several solutions can mitigate the challenges facing the California liability insurance market. Developing innovative risk management strategies, particularly those incorporating technology, is crucial. Insurers should also consider promoting consumer education and awareness initiatives to ensure policyholders understand their coverage and make informed decisions. Collaboration among stakeholders, including insurers, policyholders, and regulatory bodies, can help foster a more sustainable and accessible insurance market.

Last Point

In conclusion, California’s liability insurance market in 2024 is a dynamic blend of economic pressures, legislative actions, and evolving consumer needs. Understanding the interplay of these forces is critical for both insurers and policyholders. This report offers a detailed analysis of the current trends, providing valuable insights into the future direction of the market. By proactively addressing the emerging challenges and opportunities, stakeholders can navigate the evolving landscape effectively.

User Queries

What are the key factors influencing liability insurance premiums in California?

Several factors influence premiums, including inflation, interest rates, economic growth, claim frequency, and severity, and specific legislation impacting different policy types.

How are technological advancements impacting liability insurance claims management?

Technological advancements are changing how claims are managed, potentially leading to more efficient processing and potentially lower costs. This includes the use of data analytics and digital tools.

What consumer protection measures are in place for liability insurance in California?

California has consumer protection measures in place to ensure fair practices and transparency in the liability insurance market, such as regulations and complaint procedures.

What is the projected impact of pending legislation on liability insurance policies in California?

The impact of pending legislation on various policy types is complex and requires detailed analysis of the specific provisions and their potential effect on premiums and coverage.