Car insurance for high performance vehicles is a whole different kettle of fish compared to bog-standard motors. These beasts come with a unique set of risks, from potential for higher accident severity to the sheer cost of repairs. We’ll delve into the specifics, looking at how performance, modifications, and even your driving style can impact your premiums.

Getting the right cover for your high-octane ride is crucial. This guide will break down the ins and outs of insurance for high-performance vehicles, helping you navigate the complexities and find the best deal. We’ll explore everything from understanding your specific needs to finding the perfect insurance provider and strategies for keeping costs down.

Understanding High-Performance Vehicle Insurance Needs

High-performance vehicles, with their enhanced power and specialized features, often command a unique set of insurance considerations. This differs significantly from insuring standard models, as the increased performance capabilities introduce specific risk factors that impact premium costs and coverage requirements. Understanding these nuances is crucial for responsible ownership and securing appropriate protection.

Unique Risk Factors

High-performance vehicles, due to their advanced engineering and specialized components, frequently involve higher accident severity potentials. This is partly due to the increased power and acceleration, leading to potentially greater impact forces in collisions. The specialized components often require specialized repair techniques and parts, significantly increasing repair costs.

Accident Severity and Repair Costs

High-performance vehicles, particularly those with tuned engines or specialized suspensions, can lead to higher accident severity and repair costs compared to standard models. The increased horsepower and torque can contribute to more forceful impacts in collisions. The sophisticated engineering in these vehicles often requires specialized parts and labor, making repairs more expensive. For example, a high-performance sports car with a carbon fiber body or advanced suspension systems will likely cost more to repair than a similar model with a standard body and suspension in the event of an accident.

Furthermore, the unique materials and technologies often demand specialized expertise, increasing the time and cost associated with the repair process.

Specific Vehicle Types and Insurance Considerations

Several high-performance vehicle types warrant particular insurance attention. Sports cars, renowned for their speed and handling, often face increased accident risk due to aggressive driving. Similarly, high-performance SUVs, with their enhanced off-road capabilities and potential for high-speed maneuvering, also require careful consideration. Additionally, vehicles modified for racing or track use demand a different approach to insurance. The increased risk of high-speed incidents and the specialized nature of the modifications necessitate a higher premium.

Modifications Affecting Insurance Premiums

Modifications to high-performance vehicles can substantially affect insurance premiums. Engine tuning, upgraded exhaust systems, and aftermarket parts, while enhancing performance, can also increase the vehicle’s risk profile. Similarly, modifications that alter the vehicle’s handling characteristics, such as suspension upgrades or specialized tires, will usually raise the insurance cost. For example, a vehicle modified for drag racing or drifting will have significantly higher insurance premiums compared to a similar model with standard specifications.

Insurance Premium Comparison

| Vehicle Model | Standard | High-Performance | Premium Difference |

|---|---|---|---|

| Sports Car (e.g., XYZ Model) | $1,500 | $2,500 | $1,000 |

| High-Performance SUV (e.g., ABC Model) | $1,200 | $2,000 | $800 |

| Modified Racing Vehicle (e.g., DEF Model) | $900 | $3,500 | $2,600 |

The table illustrates the potential premium differences between standard and high-performance models. These figures are illustrative examples and actual premiums will vary based on several factors, including location, driving record, and coverage choices.

Factors Influencing Car Insurance Premiums for High-Performance Vehicles

High-performance vehicles, often coveted for their speed and handling, command a unique set of insurance considerations. These vehicles are typically more expensive to repair and replace, and their inherent performance characteristics contribute to higher risk profiles for insurers. Consequently, insurance premiums for these cars are often significantly higher than those for standard models.Insurers assess risk based on a multitude of factors, ranging from the vehicle’s inherent characteristics to the driver’s history and location.

Understanding these factors is crucial for high-performance vehicle owners seeking to manage their insurance costs effectively.

Vehicle Performance Characteristics

The horsepower and acceleration of a vehicle are critical factors in determining its insurance premium. Higher horsepower and quicker acceleration translate to a higher potential for damage in an accident. Insurers recognize that these vehicles are capable of greater speeds and faster deceleration, increasing the severity of potential collisions. Consequently, premiums are typically higher for vehicles with exceptional performance metrics.

For example, a sports car with over 500 horsepower will likely have a significantly higher premium than a comparable sedan with a more moderate engine output. Similarly, vehicles with exceptional acceleration capabilities are viewed as more risky, leading to adjusted premium rates.

Vehicle Age and Model Year

The age and model year of a high-performance vehicle directly impact insurance rates. Newer models often have advanced safety features and better crashworthiness ratings. Older vehicles, even high-performance models, may have less robust safety features and more expensive repair costs, leading to higher premiums. Furthermore, the availability of parts and the cost of repair can fluctuate based on the vehicle’s age.

Consequently, insurers consider the model year and age when calculating premiums to account for these variables.

Performance Upgrades and Insurance Rates

Insurance rates for high-performance vehicles can vary considerably based on performance upgrades. Modifications such as aftermarket exhaust systems, suspension modifications, and performance-enhancing engine components increase the vehicle’s risk profile. These upgrades, while potentially improving the vehicle’s performance, may also reduce the vehicle’s overall safety and crashworthiness. This heightened risk is often reflected in higher insurance premiums. For instance, a vehicle with a tuned engine or a significantly modified suspension system will likely have a higher insurance premium compared to a similar vehicle with stock specifications.

Driving History and Location

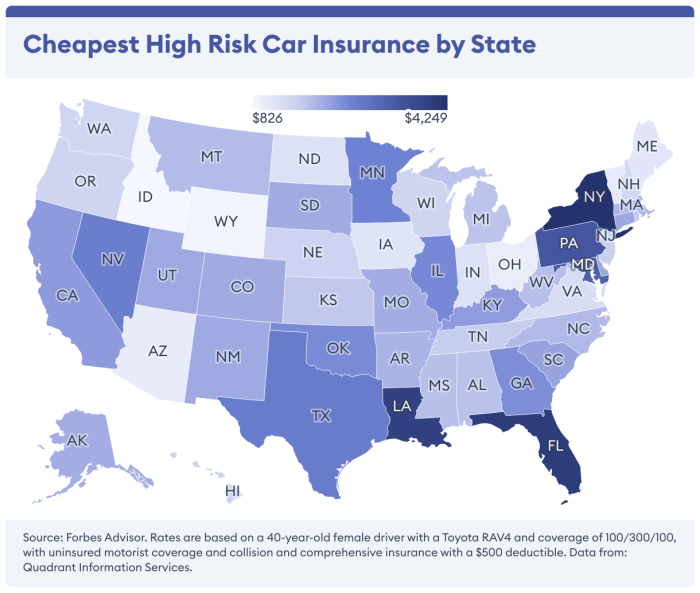

Driving history, including prior accidents and traffic violations, significantly impacts insurance premiums for all vehicles, including high-performance ones. A history of accidents or reckless driving will lead to substantially higher premiums. Likewise, the location of the driver and the vehicle’s primary use area affect insurance rates. Areas with higher rates of traffic accidents or higher risk driving patterns often see increased premiums for all vehicles, including high-performance models.

This is because insurers use local data to gauge risk.

Impact of Driving Behaviors on Premiums

| Driving Behavior | Impact on Premium |

|---|---|

| Aggressive driving (e.g., speeding, rapid acceleration/braking) | Increased premium due to heightened risk of accidents. |

| Careless driving (e.g., distracted driving, disregarding traffic laws) | Increased premium due to elevated accident probability. |

| Defensive driving (e.g., adhering to traffic laws, avoiding aggressive maneuvers) | Potentially reduced premium as it indicates lower accident risk. |

| Night driving | Increased premium as night driving often involves increased risk due to reduced visibility. |

| Driving in high-accident areas | Increased premium due to higher risk of accidents in those locations. |

Driving behavior significantly affects premiums for high-performance vehicles. Aggressive driving habits increase the likelihood of accidents and, subsequently, increase premiums. Conversely, defensive driving practices often correlate with lower premiums.

Insurance Coverage Options for High-Performance Vehicles

High-performance vehicles, with their enhanced capabilities and often higher price tags, demand specialized insurance considerations. Understanding the specific coverage options available is crucial for ensuring financial protection. This section delves into comprehensive coverage tailored for these vehicles, highlighting crucial aspects like aftermarket parts and liability.Insurance providers recognize the unique characteristics of high-performance vehicles. This necessitates coverage options that address the potential for greater risks associated with high-performance components and driving styles.

Comprehensive Coverage Options

Comprehensive insurance coverage for high-performance vehicles extends beyond the standard policies. It encompasses a broader range of potential damages, including those caused by accidents, vandalism, or even natural disasters. Policies often incorporate enhanced features designed to accommodate the high value and unique nature of these vehicles. For instance, coverage might extend to protect specialized parts, such as racing-tuned engines or lightweight carbon fiber components.

Specialized Add-ons for High-Performance Vehicles

Specialized add-ons provide further protection for the unique components of high-performance vehicles. High-performance parts coverage is a prime example. This coverage extends beyond the standard vehicle structure and specifically protects engine modifications, suspension upgrades, and other performance-enhancing parts. The policy will define the specific parts covered and their limits. For example, a policy might cover engine tuning kits up to a certain value, while other performance parts like upgraded exhaust systems may be excluded or have different coverage limits.

Importance of Aftermarket Parts Coverage

Aftermarket parts, crucial for enhancing performance, often command a high price. Their inclusion in the insurance policy is paramount. Without proper aftermarket parts coverage, a significant financial loss could result if these parts are damaged or stolen. The extent of coverage depends on the policy and the specific parts installed. For instance, if a high-performance exhaust system is damaged in an accident, coverage will ensure the replacement cost is met.

It’s crucial to ensure the policy clearly defines what aftermarket parts are covered.

Importance of Liability Coverage

Liability coverage remains a cornerstone of any insurance policy, regardless of the vehicle type. For high-performance vehicles, liability coverage is equally crucial. It protects against claims arising from accidents caused by the vehicle, ensuring financial responsibility for damages or injuries sustained by others. A comprehensive policy ensures coverage in case of accidents involving high-performance vehicles, irrespective of the driver’s experience or the vehicle’s modifications.

Insurance Coverage Table

| Coverage Type | Description | Premium Impact |

|---|---|---|

| Comprehensive | Covers damage from various causes, including accidents, vandalism, and natural disasters. | Moderate to High increase, depending on vehicle value and modifications. |

| High-Performance Parts Coverage | Specifically protects modifications like engines, suspension, and other performance parts. | Significant increase depending on the extent of the coverage and value of the parts. |

| Aftermarket Parts Coverage | Covers aftermarket components installed for performance enhancements. | Increase based on the value of the aftermarket parts and the policy’s coverage limits. |

| Liability Coverage | Covers damages or injuries to others in the event of an accident. | Moderate increase, influenced by vehicle characteristics. |

Finding the Right Insurance Provider for High-Performance Vehicles

Securing appropriate insurance for a high-performance vehicle requires careful consideration beyond the standard coverage offered for everyday cars. This often involves specialized providers and a deeper understanding of policy nuances. The unique characteristics of these vehicles, from their higher value to potential for performance-related risks, necessitates a more proactive approach in finding suitable insurance.Thorough research and comparison shopping are paramount in this process.

The insurance market offers a diverse range of providers, each with their own pricing models and coverage options. Navigating this landscape efficiently can save significant amounts of money and ensure adequate protection for your prized possession.

Research and Comparison Shopping

Understanding the importance of research and comparison shopping is crucial when choosing an insurance provider for a high-performance vehicle. Different insurers adopt varying approaches to assessing risk and pricing policies. Comprehensive research allows you to compare premiums, deductibles, and coverage options across multiple providers. This proactive approach can potentially yield significant savings compared to relying on a single provider or an insurer recommended by a friend or family member.

Identifying Specialized High-Performance Vehicle Insurers, Car insurance for high performance vehicles

Identifying insurers specializing in high-performance vehicles is essential. These providers often have a more nuanced understanding of the unique risks associated with these cars, from higher speeds and specialized components to potential modifications that can impact coverage. This specialization translates into tailored policies that address these specific needs. Directly searching for “high-performance vehicle insurance” or “sports car insurance” can narrow your search effectively.

Reviewing online reviews and testimonials from other high-performance vehicle owners can offer valuable insights into insurer reliability and responsiveness.

Importance of Policy Terms and Conditions

Thorough review of policy terms and conditions is vital. While the initial premium might seem attractive, scrutinizing the fine print reveals important details about exclusions, limitations, and specific coverage. Understanding the details of specific clauses, such as those related to modifications, accidents, and usage limitations, helps ensure complete protection and avoid surprises. Many high-performance vehicles are modified, and these modifications can impact coverage and premiums, so clearly understanding the policy’s stance on these modifications is critical.

Utilizing Online Comparison Tools

Online comparison tools can simplify the process of finding affordable insurance options for high-performance vehicles. These tools allow you to input vehicle details, coverage requirements, and preferences to generate quotes from multiple insurers. By streamlining the comparison process, these tools can save significant time and effort. Furthermore, many online tools allow for customization of coverage options, ensuring a better fit for your needs and budget.

Consider utilizing these tools to get multiple quotes and compare different policy options.

Flowchart for Comparing Insurance Providers

| Step | Action |

|---|---|

| 1 | Gather vehicle details (make, model, year, modifications). |

| 2 | Identify potential insurers specializing in high-performance vehicles. |

| 3 | Use online comparison tools to obtain quotes from multiple insurers. |

| 4 | Compare premiums, deductibles, and coverage options across insurers. |

| 5 | Carefully review policy terms and conditions for exclusions and limitations. |

| 6 | Contact insurers directly for clarification on specific questions or concerns. |

| 7 | Select the insurance provider offering the best combination of price and coverage. |

Managing High-Performance Vehicle Insurance Costs: Car Insurance For High Performance Vehicles

High-performance vehicles, with their enhanced features and performance capabilities, often come with higher insurance premiums. Understanding strategies for managing these costs is crucial for responsible vehicle ownership. This section explores various methods to negotiate rates, maintain a safe driving record, and optimize preventative maintenance to minimize potential claims.

Negotiating Insurance Premiums

Insurance providers often offer various discounts and options. A proactive approach to negotiating premiums is essential. This involves understanding the specific discounts offered by different providers, researching comparable policies, and presenting a strong case for a lower premium based on factors like your driving record and the vehicle’s safety features. Thorough research and comparison shopping are vital for identifying the best possible rates.

Contacting multiple insurers and comparing quotes is crucial.

Maintaining a Good Driving Record

A clean driving record is paramount in securing favorable insurance rates. This includes avoiding traffic violations, maintaining a safe driving style, and avoiding accidents. Staying aware of local traffic laws, observing speed limits, and exhibiting cautious driving habits contribute to a positive driving record. Avoiding aggressive driving and maintaining responsible driving habits directly correlates with lower insurance premiums.

Regularly reviewing your driving record and addressing any violations promptly is key.

Preventative Maintenance and Minimizing Claims

Regular preventative maintenance plays a significant role in minimizing insurance claims. Properly maintained vehicles are less prone to mechanical failures and accidents, leading to reduced insurance costs. Adhering to manufacturer-recommended maintenance schedules, using quality parts, and promptly addressing any potential issues can prevent more serious problems down the road. Comprehensive preventative maintenance reduces the likelihood of costly repairs and subsequent claims, thereby lowering your insurance premium.

Using Telematics Devices

Telematics devices, which monitor driving behavior, can significantly impact insurance premiums. These devices track driving habits, such as speed, braking, and acceleration, providing data that insurers can use to assess risk. This data often allows insurers to offer personalized premiums based on your actual driving habits. Utilizing telematics can lead to substantial savings, as insurers reward safe and efficient driving behavior.

Data-driven insights can refine your driving style and contribute to lower insurance costs.

Tips to Reduce Insurance Costs for High-Performance Vehicles

- Comprehensive Research and Comparison Shopping: Thoroughly research and compare insurance quotes from various providers. Consider factors such as your driving record, vehicle features, and location to find the best possible rate.

- Maintaining a Safe Driving Record: Avoid traffic violations and maintain a consistent, safe driving style. This directly impacts your insurance premium. Prioritize defensive driving techniques.

- Utilizing Preventative Maintenance: Regularly maintain your vehicle to prevent potential mechanical issues and accidents. Adhering to manufacturer recommendations for servicing and repairs is key to minimizing claims.

- Implementing Telematics Devices: Leverage telematics devices to track your driving habits and demonstrate responsible driving behavior to insurers. This can result in personalized premiums based on your actual driving style.

- Reviewing and Adjusting Coverage: Assess your current coverage needs and adjust your policy accordingly. Unnecessary coverage can increase costs. Reviewing your needs and policy options is essential to optimize your coverage.

Understanding Insurance Claims for High-Performance Vehicles

Navigating the insurance claim process for a high-performance vehicle requires a specific understanding of the unique aspects of these vehicles. From the intricate mechanics and specialized parts to the often-higher value compared to standard models, these factors influence the claim procedure and potential outcomes. This section details the process, necessary documentation, potential pitfalls, and the likelihood of delays or disputes.

Filing an Insurance Claim

The claim process for a high-performance vehicle generally mirrors that of standard vehicles, but with added considerations. Firstly, immediately report the incident to your insurance provider. Provide a comprehensive account of the event, including the circumstances, damages observed, and any witnesses present. Thorough documentation from the outset is crucial. Following established reporting protocols will help ensure a smoother claim resolution.

Documentation Required for a Successful Claim

A successful claim hinges on comprehensive documentation. This includes a detailed police report (if applicable), photographs or videos of the damage, repair estimates from qualified mechanics specializing in high-performance vehicles, and any pre-accident documentation like maintenance records. Ideally, these records should reflect the vehicle’s prior condition, including its original specifications and any modifications. Maintaining meticulous records of any service or modification work is essential for accurately assessing the vehicle’s value and pre-accident condition.

Common Issues During the Claim Process

Several issues can arise during the claim process for high-performance vehicles. One common challenge is securing repair estimates from certified mechanics familiar with the vehicle’s specific components. Furthermore, determining the precise pre-accident value of the vehicle can be complex, especially if modifications or performance upgrades have been made. Differences in repair estimates from different mechanics can also lead to disputes.

Finally, verifying the authenticity of any aftermarket parts or modifications can also pose a challenge.

Potential for Delays or Disputes

Delays in high-performance vehicle claims can stem from various factors. Obtaining certified repair estimates from specialists, verifying the accuracy of pre-accident value assessments, and settling disputes over the cause of the accident can all contribute to delays. Disputes may also arise regarding the appropriate level of compensation for the vehicle’s unique features or modifications. Claims involving complex repairs, particularly if the damage affects specialized components, can take significantly longer to resolve.

Table of Common Claim Reasons for High-Performance Vehicles

| Claim Reason | Description |

|---|---|

| Collision Damage | Damage resulting from a collision with another vehicle or object. |

| Hail Damage | Damage caused by hailstorms, often affecting the vehicle’s aerodynamic components. |

| Theft | The theft of the high-performance vehicle. |

| Fire Damage | Damage caused by a fire incident, often requiring specialized repairs for specific components. |

| Mechanical Failure | Damage due to a malfunctioning part, particularly affecting performance-related systems. |

| Accidental Damage (e.g., hitting a curb) | Damage resulting from an accident not involving another vehicle, such as hitting a curb or object. |

Closing Summary

So, there you have it – a comprehensive look at insuring your high-performance machine. Remember, understanding the unique factors affecting your policy is key. Shopping around and negotiating are crucial steps, alongside maintaining a good driving record and keeping up with preventative maintenance. Armed with this knowledge, you’ll be able to confidently protect your prized possession.

Q&A

What’s the difference in insurance for standard vs. high-performance cars?

High-performance cars often have higher insurance premiums due to the increased risk of accidents, and higher repair costs. This is often linked to factors like horsepower, acceleration, and modifications. The precise difference depends on many variables.

How do modifications affect my insurance?

Modifications, like aftermarket parts, can significantly impact your premiums. Some insurers might view certain modifications as increasing the risk, leading to higher costs.

What about specific high-performance vehicle types?

Different high-performance vehicles have different risk profiles. For example, a supercar will likely have a higher premium than a modified sports coupe.

Can I negotiate my insurance premiums?

Yes, many insurers are open to negotiation. This is often a good idea, especially if you’ve got a clean driving record and a track record of good maintenance.