Best travel insurance to Japan is crucial for a smooth and worry-free trip. Navigating Japan’s diverse landscapes and vibrant culture requires careful planning, and the right insurance policy can provide peace of mind from unforeseen circumstances. This comprehensive guide explores various insurance options, highlighting essential coverage for medical emergencies, trip interruptions, and lost baggage, all tailored to different traveler profiles.

From budget travelers to adventure seekers, understanding your needs is paramount. This guide compares leading providers, delving into their features, prices, and cancellation policies. It also provides a step-by-step claims process, ensuring you know what to expect should the unexpected occur. Armed with this knowledge, you can confidently choose the best travel insurance to Japan.

Introduction to Travel Insurance in Japan

Travel insurance is a crucial component of any trip to Japan, offering a safety net against unforeseen events. It mitigates potential financial losses arising from medical emergencies, trip disruptions, or lost belongings, allowing travelers to focus on enjoying their experience without the constant worry of unexpected expenses. Understanding the various types of coverage and key factors in selecting a suitable policy is essential for a smooth and worry-free journey.

Types of Travel Insurance Plans

Travel insurance plans are typically categorized based on the scope of coverage. Basic plans often focus on medical emergencies and trip interruptions, while comprehensive plans include additional protections like lost baggage, travel delays, and cancellation. The choice depends on the traveler’s budget, risk tolerance, and anticipated travel needs.

Key Factors to Consider When Choosing a Plan

Several factors influence the selection of an appropriate travel insurance plan. The traveler’s pre-existing medical conditions, the duration of the trip, and the planned activities are crucial considerations. Budgetary constraints and the specific needs of the trip (e.g., adventure travel) also play a significant role. Additionally, understanding the specific coverage limits for medical expenses, trip interruptions, and baggage loss is vital.

The reputation and financial stability of the insurance provider should also be considered, ensuring the plan’s validity and prompt claims processing.

Comparison of Coverage Types

| Coverage Type | Description | Typical Coverage Limits | Examples of Coverage |

|---|---|---|---|

| Medical | Covers expenses related to medical emergencies, including hospitalizations, doctor visits, and necessary medications. | Vary widely, from a few thousand USD to unlimited amounts for comprehensive plans. Individual policies may have deductibles and/or co-pays. | Emergency surgeries, ambulance transportation, necessary medications, doctor consultations. |

| Trip Interruption | Provides financial assistance if the trip is unexpectedly interrupted due to unforeseen circumstances like natural disasters, medical emergencies, or family issues. | Often includes reimbursement for non-refundable travel expenses, such as flights and accommodation. Limits vary based on the policy. | Flight cancellations due to weather, unforeseen illness or death of a family member, or government-mandated travel restrictions. |

| Baggage | Covers the loss or damage of personal belongings during the trip. | Usually capped amounts per item or total loss. Policies may have exclusions for certain items. | Lost or damaged luggage, theft of personal items, or damage to belongings due to unforeseen circumstances during transport. |

Note: Coverage limits and exclusions vary significantly between policies. It is crucial to review the specific policy documents carefully before purchase. Comparison shopping across different providers is recommended to find the best value.

Essential Coverage for Japan Travel

Comprehensive travel insurance is crucial for a smooth and worry-free trip to Japan. Beyond the inherent risks of international travel, Japan presents unique considerations. Accidents, illnesses, and unforeseen circumstances can disrupt travel plans and incur substantial expenses. Appropriate insurance mitigates these risks, providing financial protection against a range of potential issues.Travel insurance policies tailored for Japan often incorporate specific provisions to address local medical needs and emergency situations.

Understanding the specific types of coverage is paramount for informed decision-making.

Medical Emergency Coverage

Medical emergencies can arise unexpectedly during any trip. Travel insurance in Japan typically covers expenses associated with medical treatment, including hospitalisation, doctor visits, medication, and ambulance services. Policy specifics dictate the extent of coverage, including the maximum amount payable for each service and any deductibles or co-pays. Crucially, pre-existing medical conditions are often excluded or require additional clarification and potentially higher premiums.

Policyholders should carefully review their policy documents to understand the limitations and exclusions. International medical evacuation, should it be required, is another critical aspect of coverage.

Finding the best travel insurance for Japan can be tricky, but it’s crucial for a smooth trip. If you’re also looking for a new home, check out the listings for homes for sale fulton ms here. Once you’ve found your perfect place, you can focus on securing the right travel insurance to ensure your trip to Japan goes without a hitch.

Trip Interruption Coverage

Trip interruption coverage addresses unforeseen circumstances that force the cancellation or curtailment of a trip. This includes situations such as natural disasters, serious illnesses or injuries to the traveler or a close family member, or unforeseen circumstances requiring immediate return. For example, a sudden and severe illness of a family member in the traveler’s home country might necessitate an immediate return.

A major earthquake or typhoon in the travel destination could make the trip unsafe or impossible to continue. Travel insurance policies define the specific events that trigger this coverage and the compensation payable. The amount of compensation is often linked to the remaining trip costs.

Baggage Insurance Coverage

Baggage insurance is vital for protecting personal belongings during travel. It covers the loss, damage, or theft of checked or carry-on luggage. Policies typically Artikel limits on the amount covered for each item and the total covered value of lost or damaged possessions. For instance, a policy might cover a maximum of USD 1,000 for lost luggage.

The insured should carefully note that the coverage often excludes items like electronics, jewellery, or high-value goods that are not properly declared.

Emergency Evacuation Coverage

Emergency evacuation coverage is critical for ensuring medical assistance and safe repatriation in extreme circumstances. This often includes situations like medical emergencies requiring urgent and potentially expensive evacuation from the travel destination. If a medical condition arises that necessitates immediate evacuation to a medical facility outside of Japan, travel insurance should cover the associated costs. The coverage often encompasses costs for air ambulance transport, medical care during transit, and repatriation to the traveler’s home country.

This coverage is typically an add-on to a standard policy and may require additional premiums.

Comparing Popular Travel Insurance Providers for Japan

Selecting the right travel insurance for a trip to Japan requires careful consideration of various factors, including coverage specifics, price, and provider reputation. This comparison analyzes key aspects of popular providers to aid travelers in making an informed decision. Understanding the strengths and weaknesses of each option, alongside detailed cancellation policies, will enable travelers to choose a plan that best suits their needs and budget.

Comparison of Features and Coverage

Evaluating travel insurance providers involves examining their comprehensive coverage options. Different providers tailor their plans to various needs, with some prioritizing comprehensive medical emergencies while others emphasize trip disruptions or cancellation protection. Understanding the scope of each provider’s offerings is crucial for travelers to identify the coverage that aligns with their unique circumstances and travel style.

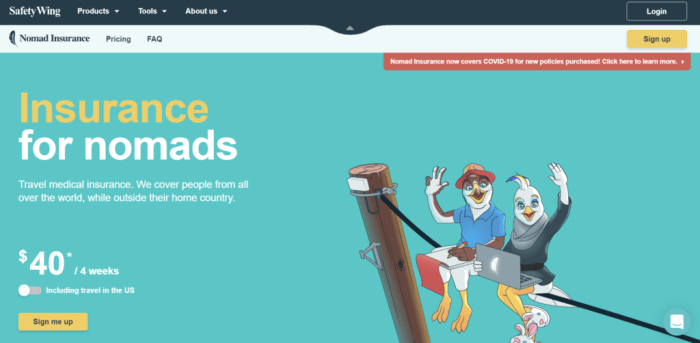

- AIG Travel Insurance: AIG often provides robust medical coverage with high limits for hospital stays and medical emergencies. Their cancellation policies, however, might have specific stipulations that are less favorable than other providers, depending on the circumstances. For example, if a trip is cancelled due to a non-medical emergency, the cancellation policy might have a higher deductible compared to other options.

- World Nomads: Known for its flexibility and extensive coverage for adventure activities, World Nomads may not offer the same level of comprehensive medical coverage as AIG. The cancellation policy for World Nomads is often structured to cater to travelers seeking adventure or exploring remote areas, with different conditions than those for more conventional travel.

- Allianz Global Assistance: Allianz typically offers a balanced approach, combining reasonable medical coverage with a good range of trip cancellation protection. Their policies may present a more moderate approach to medical and cancellation provisions compared to other providers. For instance, they might have a middle ground on medical coverage limits and cancellation conditions, fitting a wider range of travelers.

Analysis of Cancellation Policies

Cancellation policies are a critical element of travel insurance, especially for unexpected events that might impact travel plans. A thorough examination of these policies across various providers is essential for travelers to understand the potential implications of trip disruptions.

- AIG: AIG’s cancellation policies often include stipulations for pre-existing conditions. They might also have specific clauses related to travel disruptions due to natural disasters, with differing conditions based on the policy. For example, they might have specific limitations regarding natural disasters affecting the region of travel.

- World Nomads: World Nomads often offers flexible cancellation policies, particularly for adventurous activities or remote destinations. Their approach to cancellation might be less restrictive for unforeseen circumstances, but the level of medical coverage might be lower compared to other providers.

- Allianz: Allianz policies typically offer a more comprehensive approach to cancellation, encompassing various reasons for trip disruptions. For instance, the coverage might be wider for disruptions caused by travel advisories compared to other providers, though the details might vary depending on the specific policy.

Price Comparison and Coverage Options

A crucial aspect of selecting travel insurance is understanding the price structure and coverage options. Different providers offer varying tiers of protection, which translate into different cost structures. A table illustrating the price ranges and coverage options for the selected providers is provided below.

| Provider | Price Range (USD) | Coverage Options |

|---|---|---|

| AIG | $50-$200+ | Comprehensive medical, trip cancellation, baggage loss |

| World Nomads | $50-$150+ | Adventure activities, trip interruption, medical |

| Allianz | $75-$250+ | Medical emergencies, trip cancellations, lost luggage |

Coverage Specifics for Different Traveler Profiles: Best Travel Insurance To Japan

Travel insurance in Japan should be tailored to individual needs, considering various factors like travel style, duration, and planned activities. Different traveler profiles have distinct insurance requirements. Understanding these nuances allows for more effective risk mitigation and peace of mind. This section will delve into specific coverage needs for diverse traveler types.

Solo Travelers

Solo travelers require insurance that addresses potential risks unique to their circumstances. A comprehensive policy should cover medical emergencies, lost or stolen belongings, and unforeseen trip interruptions. Crucially, emergency evacuation and assistance services are vital, as solo travelers might lack immediate support networks. For example, a solo backpacker might experience an injury requiring immediate medical attention and transportation.

- Emergency Medical Expenses: Comprehensive coverage for hospitalisation, surgery, and repatriation is essential.

- Personal Liability Protection: Covers potential liability from accidental injury or damage to others.

- Trip Interruption or Cancellation: Provides financial support if the trip needs to be altered or cancelled due to unforeseen circumstances like illness or natural disasters.

- Lost or Stolen Documents: Coverage for replacement of crucial travel documents like passports or visas.

Families with Children

Families traveling with children necessitate specific considerations in travel insurance. Policies should prioritize medical expenses, including those for children. Additional coverage for lost luggage and trip disruptions is important, as children are more susceptible to minor mishaps. The policy should also consider the added cost of unexpected medical situations, potentially including urgent repatriation.

- Comprehensive Child Medical Coverage: Covers medical emergencies and treatments for children, with specific clauses for pre-existing conditions.

- Emergency Evacuation and Repatriation: This coverage is crucial for children, especially in situations requiring rapid response.

- Loss of Luggage Coverage: Crucial for families to cover the cost of replacing essential items for the children.

- Coverage for Accidental Injuries and Illnesses: Covers injuries or illnesses that may arise during the trip, which can be more frequent with children.

Adventure Travelers

Adventure travelers require insurance that encompasses higher-risk activities. Specific coverage for activities like hiking, skiing, or rock climbing is necessary. The policy should consider potential injuries, and include provisions for evacuation in remote areas. The need for specialised medical treatment and repatriation, if needed, is high in these situations.

- Specific Coverage for Extreme Sports: This clause covers potential injuries from activities like mountaineering, diving, or white-water rafting.

- Emergency Medical Evacuation in Remote Areas: This is critical for situations where conventional transport is unavailable.

- Coverage for Equipment Damage or Loss: This clause covers loss or damage to adventure equipment, ensuring the traveler can continue the journey.

- Waiver of Pre-existing Conditions: This ensures the policy will cover any medical needs arising from a pre-existing condition, particularly important for high-risk adventure activities.

Budget Travelers

Budget travelers often require a more basic travel insurance policy that focuses on essential coverage. Medical emergencies and trip disruptions are still critical, but the level of coverage for lost luggage and other incidentals may be less extensive. A cost-effective policy with a reasonable premium is a primary concern. A good example is a policy that covers medical emergencies up to a certain limit.

- Essential Medical Coverage: Covers basic medical expenses, ensuring access to essential healthcare.

- Limited Trip Cancellation and Interruption: Provides limited financial support for trip cancellations or interruptions.

- Basic Lost Luggage Coverage: Covers a certain amount of lost or damaged luggage.

- Emergency Assistance Services: Provides access to assistance in case of emergencies, but with a potentially limited scope.

Claims Process and Customer Support

Navigating the claims process for travel insurance is crucial for travelers. A clear understanding of the procedures, documentation requirements, and available support channels can significantly ease the process in case of unforeseen circumstances. This section details the typical claims process in Japan, emphasizing the steps to follow during emergencies and outlining the customer support options provided by insurance providers.

Typical Claims Process

The claims process for travel insurance in Japan typically involves a series of steps designed to ensure a fair and efficient resolution. These steps often include initial notification, documentation submission, assessment of the claim, and finally, the payment of benefits. A crucial aspect of the process is adhering to the insurance provider’s specific guidelines and timelines.

Filing a Claim

Filing a claim effectively hinges on a clear understanding of the procedure and required documentation. Contacting the insurance provider promptly and accurately reporting the incident is paramount. The insurer will likely guide you through the process and provide specific instructions on how to proceed, often involving online portals, phone support, or email. A crucial step involves meticulously gathering all necessary supporting documents, as detailed in the table below.

Failure to provide required documents may lead to delays or rejection of the claim.

Customer Support Options

Insurance providers offer diverse customer support options to assist policyholders. These include 24/7 phone lines, email addresses, dedicated online portals, and frequently asked questions (FAQ) sections on their websites. These options ensure accessibility and responsiveness, regardless of the time zone or location. Utilizing these resources can expedite the claims process and provide valuable support during challenging situations.

Documents Required for a Claim

Thorough documentation is essential for a successful insurance claim. The specific documents needed may vary depending on the type of claim, but generally, these are required:

| Document Type | Description | Example |

|---|---|---|

| Policy details | Policy number, policyholder’s name, contact information, and dates of travel. | Policy number: 123456789; Policyholder’s name: John Doe; Contact number: 123-456-7890; Travel dates: 2024-03-15 to 2024-03-22 |

| Incident report | Detailed account of the incident, including dates, times, locations, and descriptions of injuries or damages. | Report from the police or hospital; Description of medical treatment received; Account of damage to belongings |

| Medical records | Medical bills, doctor’s notes, and prescriptions, if applicable. | Hospital bills; Doctor’s notes documenting injuries and treatment; Prescriptions |

| Supporting documents | Receipts, photographs, or other evidence supporting the claim. | Photographs of damaged belongings; Receipts for medical treatment; Police reports |

Tips for Choosing the Right Plan

Selecting appropriate travel insurance for a trip to Japan requires careful consideration beyond basic coverage. A thorough understanding of policy specifics, potential exclusions, and comparative analysis of providers is crucial for optimal protection. This process involves a critical evaluation of individual travel needs and risk tolerance, ultimately leading to a plan that aligns with these factors.

Crucial Questions to Ask Before Purchase

Understanding the scope of coverage is paramount before committing to a travel insurance policy. Travelers should ascertain the extent of medical expenses covered, including pre-existing conditions and emergency evacuation. Furthermore, comprehensive coverage should extend to lost or damaged belongings, trip cancellations, and unforeseen delays. Specific questions to ask include the maximum payout amounts, the process for filing a claim, and the timeframe for processing claims.

Clarifying policy terms for activities like skiing, scuba diving, or other potentially hazardous pursuits is also essential.

Importance of Reading the Fine Print

The fine print of travel insurance policies often contains critical details that may not be immediately apparent. Carefully reviewing these terms and conditions is essential for comprehending the precise coverage provided. This process allows travelers to identify potential limitations or exclusions. Understanding the limitations associated with pre-existing conditions, specific medical procedures, or particular travel activities is vital.

The policy’s definition of “emergency” and the criteria for coverage under various scenarios should be meticulously reviewed.

Potential Exclusions and Limitations

Travel insurance policies frequently include exclusions that limit coverage for specific situations. These exclusions may relate to pre-existing medical conditions, certain activities, or specific destinations. Examples of potential exclusions include coverage for conditions that arose before the trip, or injuries sustained while engaging in reckless behavior. Policies may also limit coverage for specific types of medical treatment or procedures.

Likewise, travel insurance policies often exclude coverage for losses resulting from war, terrorism, or natural disasters that are deemed to be of a catastrophic nature. A thorough understanding of these exclusions is crucial for informed decision-making.

| Exclusion Category | Example |

|---|---|

| Pre-existing Conditions | Coverage may be limited or excluded for conditions diagnosed before the trip’s commencement. |

| Specific Activities | Coverage may not extend to activities like extreme sports or skydiving, depending on the policy. |

| Certain Destinations | Some policies may not cover travel to specific regions or countries with political instability or heightened security risks. |

Resources for Policy Comparison, Best travel insurance to japan

Several resources can aid travelers in comparing travel insurance policies. Online comparison websites can facilitate a side-by-side evaluation of various plans, allowing for a comprehensive assessment of different provider options. Consumer protection agencies and travel industry publications often publish reviews and ratings of insurance providers. These resources offer independent evaluations that help travelers make informed choices.

Recent Trends in Travel Insurance for Japan

Recent years have witnessed significant evolution in travel insurance policies tailored for Japanese travel, reflecting shifts in global travel patterns, emerging risks, and regulatory adjustments. These developments necessitate a deeper understanding for travelers to make informed decisions, ensuring comprehensive protection against potential disruptions and unforeseen circumstances. A proactive approach to researching and selecting suitable insurance is critical.

Evolving Coverage Options

Travel insurance policies for Japan are increasingly encompassing a broader range of potential issues. Beyond traditional coverage for medical emergencies and trip cancellations, policies are incorporating enhanced provisions for natural disasters, such as earthquakes and typhoons, which are prevalent in the region. This reflects the growing recognition of the need for insurance to cover the unique risks inherent in travel to a geologically active area.

Furthermore, some policies now include provisions for personal liability, lost baggage, and even disruptions due to political instability, acknowledging the global interconnectedness of events.

Emerging Risks and Considerations

The landscape of travel risks is constantly evolving. Cybersecurity threats, including data breaches and online scams, are becoming more prevalent. Travel insurance policies are adapting to these modern challenges by incorporating coverage for expenses related to these risks. Furthermore, the rise of remote work and digital nomads has introduced new travel patterns, prompting insurance providers to develop policies catering to this evolving demographic.

Finding the best travel insurance for Japan can be tricky, but it’s essential for a smooth trip. To fuel up for all your adventures, consider grabbing some delicious pizza at Nancy’s Pizza Roswell GA, a local favorite known for its tasty pies. Once you’ve fueled up, you’ll be ready to research and compare various travel insurance options tailored for Japan, ensuring you’re well-protected during your trip.

Policies now need to consider the potential for work-related disruptions or the need for extended stays due to unforeseen circumstances.

Regulatory Changes Affecting Policies

Japanese government regulations regarding travel insurance may influence policy offerings. Changes in regulations concerning medical treatment costs and repatriation processes could directly impact the structure and pricing of travel insurance plans. Furthermore, the growing trend of international collaborations and agreements on medical care could potentially lead to changes in how insurance companies handle claims in international settings. Travelers should stay informed about any regulatory updates in Japan and the broader international landscape to ensure the best possible coverage.

Utilizing Online Comparison Tools

Online platforms provide a convenient means to compare various travel insurance policies for Japan. These tools often allow for customized searches, enabling travelers to filter options based on specific needs and desired coverage levels. This facilitates a systematic approach to policy selection, ensuring that the chosen plan aligns with individual circumstances. Such platforms also often provide comparative pricing and coverage summaries, making the process efficient and transparent.

For example, a user could input their travel dates, destination (Japan), and desired coverage to receive a tailored list of options.

Ultimate Conclusion

In conclusion, securing the best travel insurance to Japan is an investment in your peace of mind. This guide has equipped you with the necessary knowledge to choose a policy that aligns with your specific travel style and budget. By understanding coverage options, provider comparisons, and the claims process, you can confidently embark on your Japanese adventure, knowing you’re protected against potential challenges.

Remember to carefully read the fine print and consider your unique needs to make an informed decision. Safe travels!

FAQ Summary

What types of medical emergencies are typically covered by travel insurance in Japan?

Most policies cover medical emergencies like accidents, illnesses, and necessary hospitalizations. Specific details regarding pre-existing conditions, ambulance fees, and dental care may vary, so always check the policy details.

What are some common reasons for trip interruption coverage?

Trip interruptions can arise from natural disasters, severe illnesses, or family emergencies. The policy will Artikel specific circumstances triggering coverage and any associated limitations.

How does baggage insurance typically work in Japan?

Baggage insurance covers lost or damaged belongings during your trip. Policy limits and exclusions should be thoroughly reviewed, as they may differ based on the provider.

What documents are typically required for filing a travel insurance claim in Japan?

Claim documentation often includes proof of purchase, details of the incident, medical bills, and any necessary supporting documents.