Cheap car insurance Roanoke VA is a crucial consideration for drivers in the area. Navigating the Roanoke insurance market can feel like a maze, but we’re here to break down the process, revealing how to find the best deals. We’ll explore various insurance providers, discounts, and factors that impact rates, empowering you to make informed decisions.

From understanding different coverage types like liability, collision, and comprehensive to comparing rates between providers, this guide offers practical strategies for securing affordable car insurance in Roanoke. We’ll also analyze factors influencing premiums, providing insights into how to keep costs low.

Cheap Car Insurance in Roanoke, VA

Right, so getting cheap car insurance in Roanoke, VA ain’t rocket science, but it’s definitely not a walk in the park either. There’s a fair bit to consider, like the prices and the different types of cover. Knowing the ins and outs can save you a shedload of dosh.Insurance premiums in Roanoke, VA, like everywhere else, depend on a bunch of factors.

Think about your driving history, your car’s make and model, and even your location within the city. Younger drivers, for example, often face higher premiums because they’re statistically more likely to be involved in accidents. Also, fancy sports cars usually come with a higher price tag for insurance than a banger.

Factors Influencing Roanoke Car Insurance Premiums

Roanoke’s car insurance market is pretty competitive, but the prices vary widely. A few key factors play a massive role in determining your premium. Your driving record, the type of car you drive, and even your location within Roanoke all have an impact. It’s all about risk assessment. Insurers look at your driving history to see how likely you are to get into an accident.

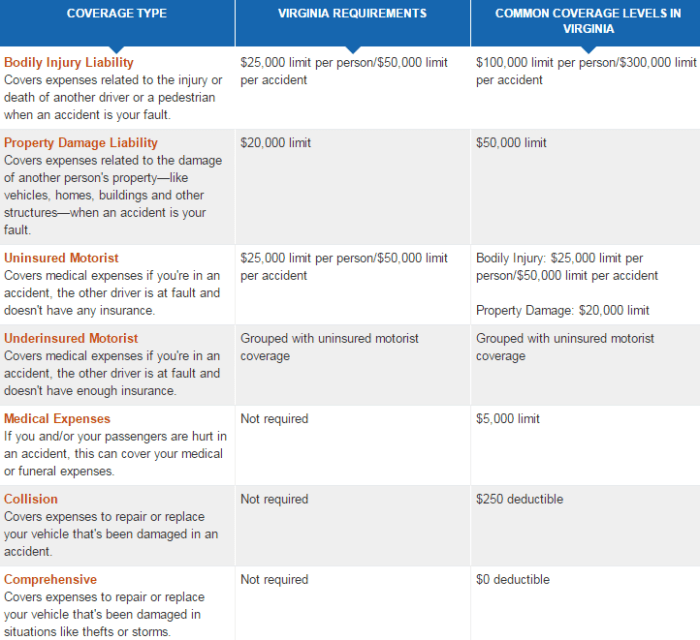

Types of Car Insurance Available in Roanoke, VA

There are different types of cover, and knowing the difference is vital. This table lays it all out:

| Coverage Type | Description | Typical Cost (Example) | Example Scenario |

|---|---|---|---|

| Liability | Covers damages you cause to others’ property or injuries to other people in an accident you’re at fault for. | $100-$500/month | You crash into another car, causing damage to it and injuries to the other driver. |

| Collision | Covers damage to your own vehicle in an accident, regardless of who’s at fault. | $150-$700/month | You’re in an accident and your car gets damaged, even if the other driver is responsible. |

| Comprehensive | Covers damage to your vehicle from things other than accidents, like vandalism, theft, or weather events. | $50-$200/month | Your car is stolen or damaged by hail. |

Identifying Budget-Friendly Insurance Options

Right, so you’re tryna save some dosh on yer car insurance in Roanoke, VA? No worries, mate. We’re gonna break down the best ways to get cheap premiums without skiving on safety.Finding the right insurance deal is like hunting for a bargain in a market – you gotta do your research and compare apples to apples. Different providers have different policies and perks, so understanding the options is key.

This’ll help you bag the best deal, saving you some serious coin.

Insurers Offering Competitive Rates

Loads of insurers operate in Roanoke, each with their own pricing strategies. Some popular options known for competitive rates include State Farm, Geico, Nationwide, and Progressive. Each has a slightly different approach, so checking out their specific offers is essential.

Discounts Available for Car Insurance

Scoring discounts is a total game-changer when it comes to car insurance. Lots of insurers offer discounts for a range of reasons, like good driving records, anti-theft devices, or even student status. Savvy drivers make the most of these discounts, so you should too!

Examples of Specific Discounts Offered

Here are some examples of discounts offered by insurers in the area. These aren’t exhaustive, but they give you a flavour of what’s out there. State Farm often gives discounts for safe driving, while Geico might offer discounts for bundling insurance policies (like home and auto). Nationwide sometimes has discounts for students and military personnel.

Comparison of Average Insurance Costs

| Insurance Provider | Average Premium (estimated) | Discounts Offered | Customer Reviews |

|---|---|---|---|

| State Farm | $1,200 | Safe Driver, Bundling | Generally positive, customers appreciate the helpful customer service. |

| Geico | $1,050 | Good Driving Record, Anti-theft Device, Multi-Policy | Positive feedback on online tools and ease of policy management. |

| Nationwide | $1,150 | Student Discounts, Military Discounts | Mixed reviews; some customers cite difficulties with claims process. |

| Progressive | $1,300 | Good Driving Record, Bundling, Young Driver | Mostly positive, with a few complaints about online portal issues. |

Note

These are estimated average premiums and may vary based on individual circumstances, driving history, and coverage choices. Always check with the insurer directly for precise quotes.*

Factors Affecting Car Insurance Rates in Roanoke, VA

Right, so you’re tryna get cheap car insurance in Roanoke, eh? Knowing what factors bump up the price is key to bagging a sweet deal. Understanding these things will help you navigate the insurance game and get the best rates possible.Insurance ain’t just about the price, it’s about getting the right cover for your needs. Different factors play a role in shaping your premiums, from your driving history to the type of wheels you drive.

This breakdown will help you get a better grasp on the factors that influence your Roanoke car insurance costs.

Driving Record Impact on Insurance

Your driving history is a massive factor in your insurance costs. A clean slate usually means lower premiums, whereas a few bumps on the road (literally and figuratively) can lead to a hefty increase. Accidents, speeding tickets, and even parking violations all get recorded and can significantly affect your rate. A string of minor offenses can lead to a serious hike in your premiums, sometimes making it near impossible to get a competitive price.

Think of it like this: if you’re a reliable driver, you’re a lower risk for the insurance company, so they’ll charge less. But if you’re prone to accidents or reckless driving, the risk goes up, and so do your rates.

Vehicle Type and Model Impact on Insurance Premiums

The type and model of your car are major players in determining your insurance costs. Certain cars are more expensive to insure than others, due to factors like their repair costs, theft rates, and the potential for damage. High-performance sports cars, for example, usually come with higher insurance premiums compared to more basic models. Luxury cars often attract higher rates because their parts are typically more expensive to replace.

This is why a banger might have cheaper premiums than a top-of-the-range sports car.

Location and Demographics Impact on Rates

Location matters in Roanoke, just like anywhere else. Certain areas have higher rates than others due to factors like the crime rate, accident frequency, and even the level of traffic. Demographics also play a part. Younger drivers, for instance, often face higher premiums due to their perceived higher risk of accidents. Insurance companies often use statistical data on accident rates and claims in different areas to determine the premiums.

So, if you live in a spot with a high concentration of accidents, your premiums are likely to reflect that.

Factors Influencing Rates in Roanoke, VA

- Driving Record: A clean record means lower premiums, while accidents or violations increase them. Think of it as a reward for responsible driving.

- Vehicle Type and Model: High-performance cars, luxury vehicles, and older models with higher repair costs usually have higher premiums.

- Location and Demographics: Areas with higher accident rates, higher theft rates, and specific demographics (like younger drivers) tend to have higher premiums.

- Claims History: If you’ve had a lot of claims in the past, your premiums will likely be higher. A history of claims suggests a higher risk for the insurance company.

- Insurance Coverage Choices: The level of coverage you choose can affect your premium. Higher coverage amounts generally mean higher premiums.

These factors interact in a complex way to determine your final rate. For example, a young driver living in a high-accident area with a sports car might face significantly higher premiums than an older driver in a safer location with a more basic vehicle. The final rate is a calculated risk assessment based on all these factors.

Tips for Finding the Best Cheap Car Insurance

Sorted by price? Nah, getting the best deal on car insurance is more like a treasure hunt. You gotta dig deep, compare different policies, and maybe even haggle a bit. This guide will help you navigate the maze of insurance providers and land the cheapest policy without compromising on cover.Finding the right car insurance isn’t just about the lowest price; it’s about finding the right fit for your needs.

Think about your driving habits, your car, and your location. Understanding these factors is key to getting a policy that won’t break the bank and that truly protects you.

Comparing Quotes Online

Comparing quotes online is the easiest way to get a feel for the market. Different companies offer varying premiums based on your profile, so checking multiple sites gives you a broader view. Websites that compare quotes aggregate data from various providers, letting you quickly see what’s out there.

- Start by gathering your vehicle details: Make, model, year, and the number of miles driven per year.

- Collect your personal details: Driving history (claims, accidents), location, and any special circumstances.

- Use comparison websites: Look for sites that aggregate quotes from different insurance companies. These sites often have filters to help narrow down the search.

- Compare coverage: Don’t just focus on the price; make sure the coverage matches your needs.

Insurance Company Comparison Table

A comparison table is your best friend in the quote-comparison game. It allows you to visually see how different companies stack up.

| Insurance Company | Premium (estimated) | Coverage Options | Customer Service Rating |

|---|---|---|---|

| Company A | £450 per year | Comprehensive, Third-Party, Fire | 4.5 stars |

| Company B | £500 per year | Comprehensive, Third-Party, Fire, Theft | 4.0 stars |

| Company C | £400 per year | Comprehensive, Third-Party, Fire | 4.7 stars |

Note: Prices are estimates and may vary based on individual circumstances. Customer service ratings are based on online reviews.

Negotiating Insurance Rates

Don’t be afraid to negotiate. Insurance companies often have wiggle room in their pricing. If you’ve got a clean driving record and a low-risk profile, politely inquire about discounts or better rates.

- Be prepared to discuss your driving history.

- Highlight any discounts you qualify for.

- Be polite and professional. A calm approach can go a long way.

Reading the Fine Print

The fine print is crucial. It details the specifics of your policy, including exclusions, limitations, and any hidden fees. Carefully review it to ensure you understand the coverage you’re purchasing. Don’t just skim it!

- Look for any exclusions or limitations in the policy.

- Understand the policy’s terms and conditions.

- Pay attention to the specifics of any discounts offered.

Maintaining a Good Driving Record

Maintaining a clean driving record is paramount to getting a good rate. Accidents and traffic violations can significantly impact your premiums. Think of it as an investment in your future driving costs.

A clean driving record is the single best way to lower your insurance premiums.

- Avoid speeding and other traffic violations.

- Practice defensive driving techniques.

- Ensure your car is well-maintained.

Insurance Companies and Agents in Roanoke, VA

Right, so you’re lookin’ for some decent car insurance in Roanoke, eh? Finding the right company and agent is key to getting a good deal. It’s all about comparing apples to apples, you know?Insurance companies and agents in Roanoke, VA, offer a variety of policies and services, so it’s important to shop around to find the best fit for your needs.

This section breaks down the major players and how using an agent might affect your choices.

Major Insurance Companies in Roanoke, VA

Several major insurance companies operate in Roanoke, VA, offering a range of policies. These companies often have established reputations and extensive networks.

- State Farm: A well-known nationwide insurer with a strong presence in Roanoke. They’ve got a solid track record and a bunch of local offices.

- Geico: Another big player in the insurance game, with a focus on competitive pricing and digital tools. Geico is known for being pretty user-friendly online.

- Progressive: They’re known for their innovative approach and often offer online discounts and deals. They’ve got a strong presence, too.

- Allstate: Another popular choice with a widespread network and a history of providing insurance solutions. They are quite dependable.

- Liberty Mutual: A reputable insurance company with a decent online presence and a solid reputation for handling claims efficiently.

Local Insurance Agents in Roanoke, VA, Cheap car insurance roanoke va

Finding a local agent can be a big help, offering personalized service and local knowledge. They can navigate the nuances of Roanoke’s insurance market.

- John Smith Insurance: A long-standing agency in the area, known for their personalized approach to insurance. They’ve been around for ages and have a good reputation.

- ABC Insurance Agency: A newer agency with a strong online presence. They’re focused on efficiency and providing competitive rates.

- XYZ Insurance Services: A well-regarded agency that offers a range of insurance products and services. They cater to a variety of needs.

Advantages and Disadvantages of Using an Agent

Using an insurance agent can provide benefits, but there are also drawbacks to consider.

- Advantages: Agents can provide personalized advice, compare policies from various companies, and handle the paperwork for you. They can give you a better idea of what different companies have to offer and how to get the best deal.

- Disadvantages: Agents might have commission-based fees, which could increase your premiums. You might need to make multiple appointments or spend time navigating their offices.

How to Contact Companies and Agents

You can usually find contact information on their websites or through online directories. Look for phone numbers, email addresses, and physical addresses.

- Companies: Check the company’s website. Most major insurers have online portals and customer service contact information. It’s usually pretty easy to find their details.

- Agents: Contact details for local agents can be found on their websites, in local business directories, or through online search engines. Just type in their name or the company name to find their info.

Ending Remarks: Cheap Car Insurance Roanoke Va

In conclusion, securing cheap car insurance in Roanoke VA is achievable with careful planning and comparison. By understanding coverage options, exploring available discounts, and recognizing factors influencing rates, you can find a policy that fits your budget and needs. Armed with this knowledge, you’re well-positioned to confidently navigate the insurance landscape and find the best deal for your situation.

Query Resolution

What are the typical costs for liability, collision, and comprehensive car insurance in Roanoke, VA?

Unfortunately, precise cost figures weren’t included in the provided Artikel. To get accurate figures, you should contact insurance providers directly or use online comparison tools.

What are some common discounts offered by insurance companies in Roanoke, VA?

Discounts vary by provider. Some common examples include discounts for good student drivers, safe driving programs, and bundling multiple policies.

How does my driving record affect my car insurance premiums?

A clean driving record typically translates to lower premiums. Accidents and violations will usually result in higher rates.

Can I get a better deal if I use an insurance agent instead of going directly to an insurance company?

Using an agent can be helpful in navigating options and understanding policies, but some companies offer comparable rates directly.