Cheap South Dakota car insurance is a top priority for many drivers. Navigating the complexities of insurance rates, coverage options, and discounts can feel overwhelming. This guide breaks down the key factors influencing costs and provides practical strategies for finding affordable coverage in South Dakota. We’ll cover everything from understanding your state’s minimum requirements to uncovering hidden discounts and comparing providers.

From understanding the different types of insurance available, to comparing various providers, and exploring ways to lower your premiums, this comprehensive guide empowers you to make informed decisions about your South Dakota car insurance.

Introduction to South Dakota Car Insurance

Yo, peeps! South Dakota car insurance ain’t rocket science, but it’s important to know the rules. This rundown will break down the basics, from what factors jack up your rates to the different types of coverage and the legal stuff you gotta know. Get ready to be a pro at car insurance in the Mount Rushmore state!South Dakota’s car insurance scene is pretty standard, but there are some specific things to keep in mind.

Your driving record, the type of car you drive, and even where you live can all affect how much you pay. Plus, the state has certain requirements for coverage, so it’s crucial to understand what’s needed to be legit on the road.

Factors Influencing Car Insurance Rates

Understanding what factors impact your car insurance premiums is key. Factors like your driving history (tickets, accidents, claims) directly influence your rate. A clean slate usually means lower premiums. Your vehicle’s type and value also play a role. A sporty, high-performance car will likely have a higher rate than a basic sedan.

Location matters too. Areas with higher rates of accidents or theft tend to have more expensive premiums. Finally, your age and gender can also impact your rates, but this is less common than other factors.

Types of Car Insurance Coverage

South Dakota offers a range of coverage options, like liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Liability insurance protects you if you’re at fault in an accident and cause damage to someone else’s vehicle or injury. Collision coverage pays for damages to your car if it’s involved in a crash, regardless of who’s at fault. Comprehensive coverage covers damage to your vehicle from things like vandalism, fire, or theft.

Uninsured/underinsured motorist coverage is vital if someone without insurance wrecks you.

Legal Requirements for Car Insurance

South Dakota, like most states, has mandatory minimum insurance requirements. You can’t just cruise around without the right coverage. Failure to meet these requirements can result in fines and penalties. Make sure you’re compliant with the law to avoid trouble with the authorities.

Minimum Required Coverage Levels

| Vehicle Type | Minimum Bodily Injury Liability | Minimum Property Damage Liability |

|---|---|---|

| Passenger Vehicle | $25,000 per person, $50,000 per accident | $25,000 |

| Motorcycle | $25,000 per person, $50,000 per accident | $25,000 |

| Commercial Vehicle | Requirements vary based on vehicle use and type; consult with an insurance professional for specific guidelines. | Requirements vary based on vehicle use and type; consult with an insurance professional for specific guidelines. |

Different vehicle types might have different minimum requirements for liability coverage. This table provides a general idea of the minimum coverage needed for passenger vehicles and motorcycles. For commercial vehicles, requirements can be more complex, so it’s best to consult with an insurance professional. Always check with the South Dakota Department of Insurance for the most up-to-date information.

Understanding Cheap Car Insurance Options

Yo, so you tryna snag some cheap car insurance in South Dakota? It’s totally doable, fam. This ain’t rocket science, but knowing the ropes can save you a ton of dough. We’ll break down how to get the best deals, from discounts to comparison tools.Finding affordable car insurance in South Dakota is all about strategy. It’s not just about picking the first company you see; there are ways to get major savings.

Different factors like your driving record, car type, and even where you live can impact your premiums. Let’s dive into the details to get you that sweet, sweet discount.

Methods for Obtaining Cheap Car Insurance

Finding cheap insurance ain’t just about luck. There are proven strategies that work like magic. Knowing these methods can help you land the best possible deal.

- Shop Around: Don’t settle for the first quote you get. Comparing rates from multiple providers is crucial. Think of it like hunting for the best deal on sneakers – you gotta check all the stores before you buy.

- Bundle Your Policies: If you already have other insurance like homeowners or renters, bundle them together. Many companies offer discounts for bundling. It’s like getting a combo meal at a restaurant – more bang for your buck.

- Pay Annually: Paying your premiums annually instead of monthly often nets a discount. It’s like getting a bulk discount at the grocery store.

- Improve Your Driving Record: A clean driving record is key. Avoiding accidents and traffic violations can significantly lower your premiums. Think of it like a good credit score – it opens doors.

- Consider a Safe Driver Program: Some companies offer discounts for participating in safe driving programs. These programs often teach you safe driving techniques. It’s like taking a course to become a better driver.

Discounts and Incentives

Insurers often offer discounts based on specific criteria. Knowing these can help you save big.

- Good Student Discounts: If you’re a student, some insurers offer discounts. This is a win-win – you get lower rates, and they get a loyal customer.

- Multi-Car Discounts: If you have multiple cars insured with the same company, you might get a discount. This is like a family deal at a theme park – everyone saves.

- Defensive Driving Courses: Completing defensive driving courses can often earn you discounts. It’s like getting a certification for a better driving record.

- Anti-theft Devices: Installing anti-theft devices on your car can lower your premiums. It’s a smart way to protect your investment and save money.

- Safety Features: Cars with advanced safety features like airbags and anti-lock brakes can often get you a discount. It’s like getting a warranty for your car.

Insurance Provider Comparison

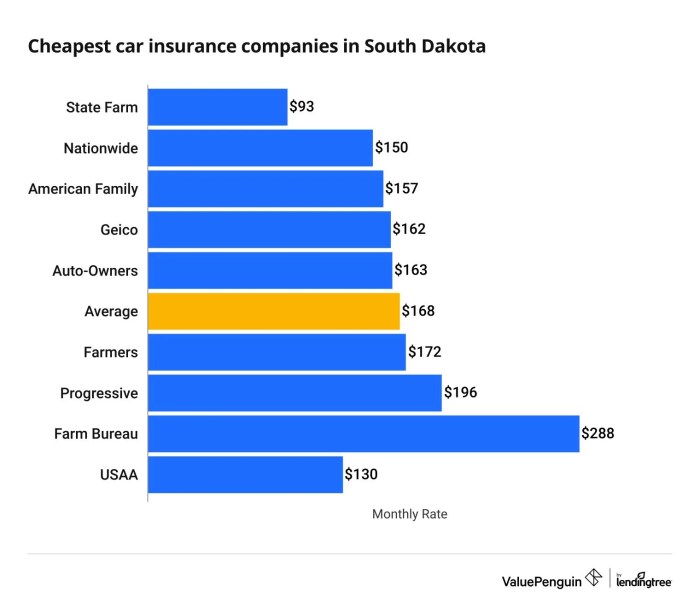

Different insurers have different pricing models. Comparing providers is crucial to find the best fit.

- State Farm: Known for its wide range of products and services. Often considered a solid option for comprehensive coverage.

- Geico: Often considered one of the more affordable options, known for their competitive pricing.

- Progressive: Known for their online tools and easy-to-use platforms.

- Allstate: A well-known provider with extensive coverage options. They also offer a wide range of discounts.

- Nationwide: Known for their flexible insurance options, including options for specific needs.

Insurance Comparison Tools

Using comparison tools can help you find the best rates. These sites allow you to compare different insurance quotes quickly and easily.

- Insurify: A comparison tool that can help you get quotes from various providers.

- Policygenius: A platform with comprehensive information on various policies.

- QuoteWizard: Provides easy-to-understand comparisons and options for different policies.

- NerdWallet: A reputable financial site that also provides car insurance comparison tools.

- Insure.com: A popular site for comparing quotes from various insurers.

Pros and Cons of Online Comparison Tools

Online comparison tools can make finding cheap car insurance a breeze. Understanding the pros and cons is essential.

| Feature | Pros | Cons |

|---|---|---|

| Ease of Use | Quickly compare multiple quotes. | May not provide detailed information on specific policies. |

| Time Saving | Save time by comparing quotes in one place. | May not offer personalized service. |

| Cost Comparison | Easily compare prices from various providers. | May not be able to find the most tailored policies. |

| Access to Information | Provide access to information on different policies. | Might not be updated regularly or provide the most recent rates. |

| Transparency | Often transparent about fees and hidden costs. | May not always be completely accurate with provider quotes. |

Factors Affecting Car Insurance Costs

Yo, peeps! Car insurance ain’t free, fam. It’s all about the risks you take on the road, and the prices reflect that. Understanding these factors is key to scoring a sweet deal. So, let’s dive into the nitty-gritty.Insurance companies gotta figure out how risky you are behind the wheel, and that impacts your premium. Think of it like this: a company that insures a bunch of reckless drivers has to pay out more in claims.

So, to cover those payouts, the premiums for everyone go up. Different factors weigh in heavily on your insurance rate, from your driving record to your ride itself.

Driving History Impact on Premiums

Your driving record is a huge deal. Accidents, speeding tickets, and even moving violations all add up to a higher risk profile. Companies use this info to determine how likely you are to cause a claim. A clean record means lower premiums, while a checkered past means higher rates. This is like getting a bad grade on a report card – you have to work harder to get better.

For example, a teen with a few minor traffic violations will likely pay more than a teen with a perfect driving record.

Vehicle Type and Age Influence on Costs

The type of car you drive matters too. High-performance cars, sports cars, or luxury vehicles are often more expensive to insure than basic sedans. This is because they’re more likely to be involved in accidents that cause higher payouts. Also, the older the vehicle, the more likely it is to have higher repair costs. Imagine a classic car; parts are harder to find and replace, which adds to the risk.

This is like buying a fancy phone; you’re more likely to get it damaged or stolen.

Location and Demographics Effect on Pricing

Where you live and your demographics play a part too. Certain areas are statistically more prone to accidents than others, so premiums are higher in those areas. For example, a city with a high population density or a lot of intersections might have higher insurance rates than a quiet, rural area. Demographics also affect pricing, with certain age groups or genders facing different rates.

It’s like renting an apartment; the location and neighborhood determine the price.

Credit History Role in Car Insurance Premiums

Your credit score, surprisingly, can impact your car insurance rates. Insurance companies use credit scores to gauge your financial responsibility. A lower credit score could mean higher premiums, as it might indicate a higher risk of not paying your insurance bill or other debts. Think of it like a bank loan; a poor credit score means you’re a higher risk.

A higher credit score shows you’re responsible and trustworthy, which translates to a lower premium.

South Dakota Car Insurance Rate Impact Factors

| Factor | Impact on Rates | Example |

|---|---|---|

| Driving Record | Excellent record = lower rates; Accidents/Violations = higher rates | A teen with no accidents will pay less than a teen with one accident. |

| Vehicle Type | Luxury/High-Performance = higher rates; Basic Sedans = lower rates | A sports car will cost more to insure than a compact car. |

| Vehicle Age | Older vehicles = higher rates; Newer vehicles = lower rates | A 10-year-old car will cost more to insure than a 2-year-old car. |

| Location | High-accident areas = higher rates; Low-accident areas = lower rates | Insurance in a city known for traffic will be more expensive than in a rural area. |

| Credit History | Good credit = lower rates; Poor credit = higher rates | Someone with a good credit score will get a lower premium than someone with a bad credit score. |

Strategies for Finding Affordable Coverage

Yo, tryna save some moolah on car insurance? It’s totally doable, fam. We’re breaking down the moves to snag the cheapest rates without sacrificing coverage. It’s all about smart choices and a little hustle.Finding affordable car insurance ain’t rocket science, but it takes a little know-how. There are tons of ways to cut costs without compromising on protection.

Let’s dive into some serious strategies.

Bundling Insurance Products

Combining your car insurance with other policies, like home or renters insurance, often unlocks sweet discounts. Insurance companies love it when you bundle, ’cause it means less work for them and more money in your pocket. Think of it like a combo meal deal – you get more for your buck. This is a major way to lower premiums.

Safe Driving Practices

This is the most important thing, yo. Driving safely is the key to getting lower premiums. The fewer accidents and claims you have, the less your insurance company has to pay out. Think defensive driving – being aware of your surroundings, not speeding, and avoiding risky maneuvers. It’s about being a responsible driver.

A great way to lower your rates.

Defensive Driving Courses

Taking a defensive driving course can help you become a better, safer driver. These courses teach you how to avoid accidents and react safely to dangerous situations. Companies often offer discounts for completing these courses, which can save you a serious chunk of change on your insurance premiums. This is a win-win – you get better at driving and save money.

Discounts for Safe Drivers in South Dakota

| Discount Type | Description |

|---|---|

| Good Student Discount | Students with a good academic record often get discounts. |

| Accident-Free Driving Discount | Years of accident-free driving history can lead to substantial savings. |

| Safe Driver Training Course Discount | Completion of a defensive driving course can result in a discount. |

| Multi-Policy Discount | Bundling car insurance with other insurance products like homeowners or renters insurance often offers discounts. |

| Low Mileage Discount | If you drive less, you may qualify for a lower premium. |

These discounts are not universally available. The availability of specific discounts will vary depending on the insurance company and your specific situation. Always check with your insurance provider for details.

Comparing Insurance Providers: Cheap South Dakota Car Insurance

Yo, peeps! Figuring out cheap car insurance in South Dakota can be a total grind. But don’t sweat it! Knowing how different insurance companies stack up is key to getting the best deal. We’re breaking down how to compare providers, from coverage to customer service to financial stability. This is your ultimate guide to scoring the lowest rates possible.Comparing insurance providers isn’t just about price; it’s about getting the right coverage for your ride and peace of mind.

You gotta look at the fine print, see what kind of perks each company offers, and make sure they’re a solid player in the game. This way, you avoid getting ripped off.

Coverage Options

Different insurance companies offer various coverage options. Some might have extra perks like roadside assistance or rental car coverage. Others might focus on the essentials. Understanding these differences is crucial to finding a policy that fits your needs and budget. Basically, you need to choose the level of coverage that suits your situation.

Think about what you want to protect in case of an accident or other issues.

Customer Service Ratings

Customer service is a major factor. A company with great reviews and a reputation for helping customers is worth considering. Look for companies that have a solid online presence and good feedback from previous customers. Bad customer service can be a real headache if you need to file a claim or have a question. Find out how the company responds to customer inquiries and complaints, and if they have multiple ways to reach out to them.

Financial Stability

A company’s financial stability is important. You want to make sure they can pay out claims if something goes down. Look for companies with a strong history and a good reputation in the industry. This is like checking if a company has a solid track record of fulfilling its obligations, ensuring you won’t be left high and dry if you need to file a claim.

A company’s financial strength can be reflected in their ratings by independent organizations or their track record of paying claims.

Claims Process

The claims process is another key area to consider. Look at how easy it is to file a claim, how long the process usually takes, and how responsive the company is to your needs. Some companies are super efficient, while others can be a real pain to deal with. This is important because a smooth claims process can make a huge difference if you need to file a claim.

Knowing the company’s process for handling claims can save you a lot of time and hassle.

Comparison Table

| Insurance Provider | Coverage Options | Pricing | Customer Service Rating (out of 5) | Claims Process Rating (out of 5) |

|---|---|---|---|---|

| InsCo 1 | Comprehensive, collision, liability, uninsured/underinsured, roadside assistance | $1200/year | 4.5 | 4.2 |

| InsCo 2 | Comprehensive, collision, liability, uninsured/underinsured, rental car | $1500/year | 4.0 | 4.8 |

| InsCo 3 | Comprehensive, collision, liability, uninsured/underinsured | $1000/year | 3.8 | 3.5 |

This table gives a basic comparison of three major insurance companies in South Dakota. Remember, prices and ratings can change, so always do your research. Don’t just settle for the first one you see! Compare the details to find the best deal for you.

Analyzing Specific Discounts

Yo, future drivers, tryna save some serious cash on insurance? Knowing the specific discounts available can seriously help you out. Different discounts are offered based on various factors, like your age, driving record, and even the type of car you drive. So, let’s dive into the deets!

Discounts for Young Drivers

Young drivers often face higher insurance premiums because they’re statistically more likely to get into accidents. But there are discounts out there specifically for you! Insurance companies recognize that many young drivers are responsible and capable of avoiding accidents. Discounts might be offered for things like good grades, driving courses, or participating in safe driving programs. This can significantly reduce your premium.

For example, a teenager who maintains a high GPA might qualify for a student discount, which in turn reduces their car insurance costs.

Discounts for Students and Seniors

Proof of being a student or senior can unlock discounts. Students often have lower insurance premiums than non-students, because insurance companies recognize the lower risk profile. Similarly, seniors often qualify for discounts as well. These discounts can be pretty sweet, potentially saving you a good chunk of change on your monthly bill.

Discounts for Safe Driving and Accident-Free Records

Maintaining a clean driving record is crucial for getting the best car insurance rates. Insurance companies reward safe drivers with discounts. The more accident-free years you have under your belt, the lower your premium is likely to be. This is a huge motivator for responsible driving habits! It’s a win-win situation, as you save money and stay accident-free.

Discounts for Specific Vehicle Types

Insurance premiums are affected by the type of vehicle you drive. If you drive a fuel-efficient car, you’ll often qualify for a discount, and you might also get a discount for a low-theft-risk car. For example, a hybrid car might qualify for a fuel-efficiency discount, making insurance cheaper. Likewise, newer, well-maintained vehicles with advanced safety features may qualify for a discount.

Table of Available Discounts

| Discount Type | Eligibility Criteria |

|---|---|

| Student Discount | Proof of enrollment in a high school or college |

| Senior Discount | Proof of age (usually 55+ or 65+) |

| Safe Driving Discount | Accident-free driving record for a specified period (e.g., 3 years) |

| Good Student Discount | Maintaining a certain GPA or academic achievement |

| Defensive Driving Course Discount | Completion of a defensive driving course |

| Vehicle Safety Feature Discount | Vehicle equipped with advanced safety features (airbags, anti-theft systems, etc.) |

| Fuel Efficiency Discount | Driving a fuel-efficient vehicle (e.g., hybrid or electric car) |

Navigating the Insurance Application Process

Getting cheap car insurance in South Dakota is totally doable, but you gotta know the ropes. The application process ain’t rocket science, but understanding the steps and documents needed can save you major headaches. Knowing what to expect will make the whole thing way smoother.The application process for car insurance involves several key steps, from gathering required documents to actually submitting the application.

Understanding the process ensures a smooth experience and helps you avoid common pitfalls that can delay or even block your application. This section breaks down the application process, equipping you with the knowledge to get the best possible deal.

Steps Involved in Obtaining a South Dakota Car Insurance Quote

Getting a quote is the first step. This involves providing information about your vehicle, driving history, and personal details to insurance providers. Insurance companies use this data to assess your risk profile and determine a suitable premium. Different providers use different methods for quoting. Some use online tools, while others require a phone call or in-person meeting.

Shop around to find the best deal.

Required Documents for Applying for Car Insurance

The documents needed vary slightly depending on the insurance provider, but generally, you’ll need:

- Proof of Identity: A valid driver’s license and state-issued ID are usually required. Make sure these are current and valid. Expired or incorrect documents will cause problems.

- Proof of Vehicle Ownership: This might include the vehicle title or a registration document, depending on the state’s requirements. Ensure the details on the document match your vehicle.

- Driving History Report: Insurance providers need your driving history to assess your risk. Check with the provider to see what format they prefer.

- Proof of Residence: Your current address is needed to confirm your location and to determine if you live in a high-risk area. Your utility bill or a recent lease agreement will suffice.

- Payment Information: The insurer needs a method for processing payments. Providing your banking information will ensure smooth processing.

Typical Underwriting Process, Cheap south dakota car insurance

Underwriting is the process where insurance companies evaluate your risk and determine your premium. It involves reviewing the documents you submitted and checking your driving history. Insurance companies use complex algorithms to assess your risk, taking into account factors like your age, driving record, vehicle type, and location. Each company’s underwriting process is unique, so research the company’s specific criteria.

Common Pitfalls and How to Avoid Them

- Inaccurate Information: Ensure all the information you provide is accurate and up-to-date. Inaccuracies can delay or reject your application.

- Missing Documents: Make sure you gather all the required documents before starting the application process. Check the insurer’s specific requirements to avoid delays.

- Not Comparing Quotes: Don’t settle for the first quote you get. Compare quotes from multiple insurers to find the best deal. It’s crucial to understand the coverage and pricing.

- Not Understanding the Coverage: Read the fine print and make sure you understand the coverage offered in the policy. Ask questions if anything is unclear.

Step-by-Step Guide for Completing an Online Insurance Application

- Choose Your Insurance Provider: Select the insurance provider that best suits your needs and budget. Research their coverage and reputation.

- Gather Required Documents: Collect all the necessary documents, ensuring they’re accurate and up-to-date. This will save you a lot of time.

- Access the Online Application: Go to the insurer’s website and locate the online application form.

- Fill Out the Application: Carefully complete all the required fields with accurate information. Double-check for errors.

- Upload Documents: Upload the required documents as instructed by the insurer. Ensure they are in the correct format.

- Review and Submit: Review all the information you’ve entered before submitting the application. Ensure everything is accurate.

- Confirmation: You’ll receive a confirmation email or message once the application is processed. Keep track of your application number.

Illustrating South Dakota Insurance Costs

Yo, peep this, car insurance in South Dakota ain’t no joke. It’s all about the location, coverage level, and even your age. Understanding the prices is key to saving some serious dough.Insurance rates in South Dakota vary widely, depending on where you live. Some areas are more expensive than others, and that directly affects your premium. Different coverage levels also impact the cost—more comprehensive coverage usually means a higher price tag.

Knowing these factors is crucial to getting the best deal.

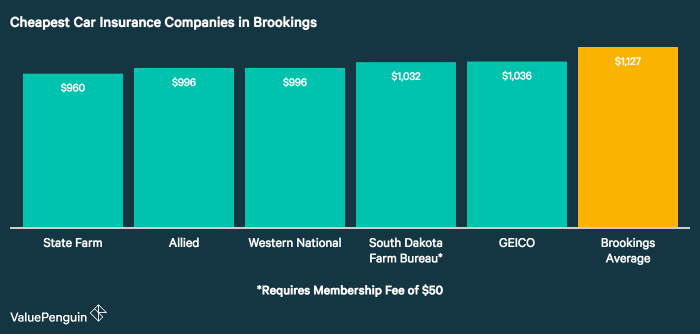

Average Costs Across South Dakota Regions

Different parts of the state see different rates. For example, the Black Hills region tends to have higher premiums than the eastern part of the state. Urban areas generally have higher costs compared to rural areas. This is because of factors like traffic density, theft rates, and the amount of damage that occurs in different areas.

| Region | Estimated Average Premium (USD) |

|---|---|

| Black Hills | $1,500 – $2,000 |

| Eastern South Dakota | $1,200 – $1,500 |

| Urban Areas (e.g., Sioux Falls) | $1,400 – $1,800 |

| Rural Areas | $1,000 – $1,200 |

Typical Costs for Different Coverage Levels

The amount of coverage you choose directly impacts the price you pay. Basic liability coverage is the cheapest, but it offers the least protection. Higher levels of coverage, like comprehensive and collision, are more expensive but provide greater protection against damages.

- Liability Coverage: The most basic coverage, protecting you from the costs of harming another person or their property in an accident. It’s the cheapest option but offers limited protection.

- Collision Coverage: This pays for damages to your vehicle regardless of who caused the accident. It’s a more expensive option, but it’s important if you want to fix your car after an accident.

- Comprehensive Coverage: This protects your vehicle from things beyond collisions, like weather damage, vandalism, theft, or fire. It’s a higher-priced option, but provides more peace of mind.

Impact of Discounts on Premiums

Discounts can significantly reduce your insurance costs. These discounts can include good student discounts, discounts for safe driving records, and even discounts for bundling your insurance with other services.

- Safe Driving Record: A clean driving record demonstrates responsible driving habits, leading to lower insurance rates.

- Bundling Insurance: Bundling your car insurance with other services like home insurance or life insurance can sometimes get you a discount.

- Good Student Discounts: Insurers often offer discounts for students who are enrolled in school.

Average Car Insurance Costs by Age

Insurance rates vary by age group. Younger drivers typically pay more due to a higher risk of accidents. Older drivers often get lower rates, showing their decreased accident risk.

(Example visual: A bar graph showing how car insurance costs rise sharply for teens and young adults, then gradually decrease as drivers age.)

Conclusion

In conclusion, finding cheap South Dakota car insurance involves understanding the factors that affect your rates, comparing providers, and utilizing available discounts. This guide provides a roadmap to finding the most affordable and suitable coverage for your needs. By applying the strategies discussed, you can confidently navigate the insurance landscape and secure the best possible deal.

Detailed FAQs

What are the minimum car insurance requirements in South Dakota?

South Dakota’s minimum requirements vary depending on the type of vehicle. A table detailing these specifics is included in the full guide.

How does my driving record affect my insurance premiums?

A history of accidents or violations can significantly increase your premiums. Safe driving practices and maintaining a clean record are crucial for lower rates.

What discounts are available for young drivers in South Dakota?

Several discounts are available for young drivers, often related to specific insurance providers and driving history. Details on specific programs are in the guide.

What are some common pitfalls to avoid when applying for car insurance?

Carefully review the application process and required documents. Common mistakes include inaccurate information or failing to disclose relevant details. A step-by-step guide to avoid these issues is available in the guide.